If you feel like you “missed the boat” on the gold rally — or even the first leg of silver’s breakout — don’t worry…

Because in the world of precious metals, silver is just getting warmed up. And the real opportunity isn’t in stacking coins or buying bars… it’s in owning the miners pulling silver out of the ground.

And not just any miners. The tiny, under-the-radar producers you’ve never heard of are handing out the biggest gains — and they’re just getting started.

Let’s break down the opportunity…

Silver’s Setup Looks Better Than Ever

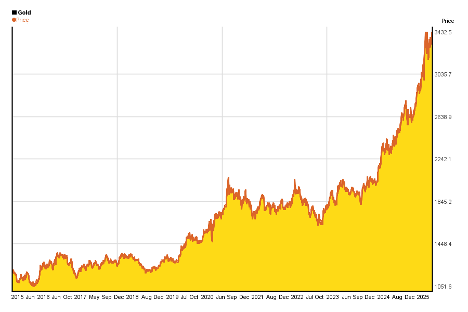

Gold made headlines in 2024 when it broke out to new all-time highs…

A chart of gold’s price appreciation since 2015. Source: Chartoasis and 5YearCharts

Central banks were buying it hand over fist. Investors were looking for safety from inflation, government debt, war, and market chaos.

But while gold was taking the spotlight, silver quietly began building a bullish setup of its own.

Now in 2025, silver is really breaking out — and it’s doing what silver always does: moving higher, and faster, than gold.

A chart juxtaposing silver and gold’s gains over the past three months. Source: TradingView

Here’s why the momentum is real:

- Industrial Demand is Soaring: Silver isn’t just a precious metal — it’s a critical industrial material. It’s used in solar panels, electric vehicles, 5G tech, and every advanced semiconductor you can think of. As AI and electrification trends accelerate, so does silver demand.

- Supply is Tight: Years of underinvestment in mining have caught up with the industry. Silver output is flatlining. That’s a dangerous setup when demand is hitting record highs. When supply can’t meet demand, prices surge.

- Gold Leads, Silver Follows — With Force: Historically, when gold starts to run, silver lags… then outpaces. This lagging behavior often frustrates investors — until it flips. That’s what we’re seeing now. Gold rallied, and now silver is sprinting to catch up, historically delivering a higher percentage gain.

- Silver is Cheap Relative to Gold: The gold-to-silver ratio — how many ounces of silver it takes to buy one ounce of gold — still sits well above historic norms. When that ratio reverts, silver prices have to move up. That’s good news if you’re early.

All signs point to silver not only climbing… but launching.

But the Real Profits Aren’t in the Metal — They’re in the Miners

Here’s the dirty secret of precious metals investing: owning physical silver or ETFs might preserve wealth… but they don’t build it fast.

If you want real upside, you have to own the companies digging silver out of the ground…

When silver prices move, the economics of silver production change drastically — and that can supercharge the stocks of mining companies.

For example: if silver goes from $25 to $30 per ounce, that’s a 20% gain…

But for a miner producing silver at a cost of $20/oz, their margins don’t go up 20% — they double. That’s the kind of leverage miners offer.

But we’re not talking about big, boring producers here. The real profits are in the little guys…

Small Miners = Huge Gains

Let’s look at the scoreboard.

So far in 2025, some of the smallest silver miners in the market have absolutely crushed their larger peers:

- Argenta Silver Corp. (AGAG.V) – up 54.35%

- Silver Storm Mining (SVRSF) – up 57.83%

- Klondike Silver Corp (KLSVF) – up 80%

- Silver Hammer Mining Corp. (HAMRF) – up 102.7%

- Apollo Silver Corp (APGOF) – up 122.55%

- Avino Silver (ASM) – up 263.4%

- Dolly Varden Silver (DVS) – up a jaw-dropping 402.24%

Now compare that to the “big names” in silver mining:

- Endeavor Silver (EXK) – up 30.74%

- Silvercorp Metals (SVM) – up 41.92%

- Pan American Silver (PAAS) – up 46.99%

- First Majestic Silver (AG) – up 52.04%

That’s not a typo. The best performing “major” minor almost did as well as the worst-performing junior operation…

So far in 2025, Dolly Varden Silver has outpaced Pan American by more than 8x.

And Avino Silver is pushing up on a 300% gain, while Endeavor Silver hasn’t even cracked a 35% return.

This is why small-cap silver miners matter.

They’re lean. They’re hungry. And when silver starts to move, they explode.

Why This Trend Is Likely to Continue

It’s not just a one-off fluke. These huge gains in small silver miners are driven by real market dynamics.

- Small Caps Have More Torque: Big miners are slow-moving giants. Small miners are rockets with afterburners. They often operate one or two high-grade properties — and if silver prices rise, the economics of those projects go vertical.

- M&A Tailwinds: As silver rallies and major producers look to grow their reserves, guess where they shop? That’s right — the juniors. Buyouts can send tiny stocks soaring overnight.

- Retail Momentum Is Shifting: With gold having already run, and large-cap miners priced accordingly, smart investors are rotating capital into the small-caps that haven’t yet peaked. That’s creating new waves of buying pressure in junior miners.

- Silver’s Fundamentals Are Only Getting Stronger: The more AI, solar, and electrification dominate the global economy, the more silver gets consumed. And the fewer high-quality silver deposits are left to find. That’s a recipe for sustained gains.

How to Play Catch-Up — And Potentially Win Big

If you’re kicking yourself for missing the early stages of gold’s breakout…

And if you’re feeling late to the silver party, too…

You’re not out of options.

The best small silver miners are still offering some of the biggest upside potential in the entire market.

You just have to know where to look.

Because while the headlines are still focused on gold ETFs and macro predictions…

The smart money is already hunting for the next Dolly Varden… the next Avino… the next small-cap silver rocket about to take flight.

Don’t Miss Out

Silver is on the move.

Industrial demand, geopolitical risk, inflation, and a hungry market are all pushing prices higher. And history tells us that silver doesn’t just follow gold — it outperforms it.

But the real story is what happens next.

The biggest winners won’t be holding coins.

They’ll be holding shares of the best-positioned small silver miners — the kind that can turn a 20% move in silver into a 200%+ gain in your portfolio.

Don’t just watch this trend happen. Get in now, while the upside is still on the table.