The Fed is Out of Solutions

By Lee Bellinger • Editor of Off-Grid Confidential Newsletter

Tues, Dec 10, 2024 9:00 A.M. CDT · 10 min read

Disseminated on behalf of West Red Lake Gold Mines Ltd.

Brace yourself.

There’s no question that thanks to Washington’s disastrous policies – and out-of-control spending – the outlook for the U.S. economy now appears dire.

And with the U.S. national debt now rising by a staggering $1 trillion every 100 days…there are no easy solutions to help get the nation back on track.

While Jay Powell and the Biden-Harris White House sweat out a federal debt that has reached $35.5 trillion – and climbing – many investors have raced to the sidelines with their cash.

But the truly savvy investors laugh while Jay Powell frets, because they understand that this ridiculous spending has also triggered a nearly unprecedented bull market for gold.

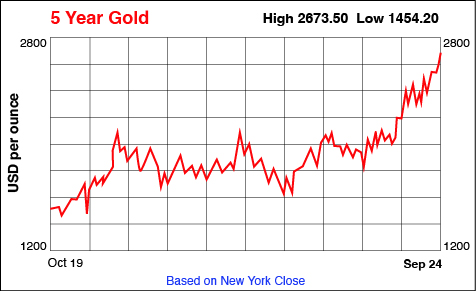

Just look at this chart for the yellow metal.

Source: goldprice.org

After testing the $2,000/ounce mark in August 2020 and February 2022, gold traded down to near $1,600/ounce in October 2022.

Since then, gold prices have been on an absolute tear and currently sit above $2,600/ounce, a $1,000/oz increase in just two short years.

But the surge in gold prices that we’ve seen over the past few years could pale in comparison to what’s on the horizon.

As shocking as it may sound, with no end in sight for the Fed’s money printing, we could see the price of gold increase by many multiples in the years ahead.

With soaring inflation, the dollar stands to lose more and more of its value, which means you’ll need a lot more dollars to buy gold.

According to legendary investor Peter Schiff, today’s seemingly-high gold price of $2,600/oz. “could soar to $26,000/oz. — or even $100,000/oz. There’s no limit because gold isn’t changing — it’s the value of the dollar that’s decreasing.”[i]

Meanwhile, as profitable as gold has been, select gold mining stocks have really kicked into high gear, handing investors even bigger profits.

For example, over the last year, as gold prices have risen by 38%, select gold mining stocks have gone on a tear, handing investors even bigger profits. For example, from November 6, 2023, to November 5, 2024:

- Coeur Mining (NYSE: CDE) handed investors a return of 136%

- Jaguar Mining (OTCM: JAGGF) returned 251%

- Montage Gold (TSXV: MAU.V) shot up 271%

- GR Silver Mining (OTCM: GRSLF) soared 273%

As this historic gold bull market continues to roar, I’ve recently discovered a soon-to-be gold producer that’s on a “golden runway” with the potential to hand investors strong returns in the current environment.

That’s a company backed by one of the most successful mining entrepreneurs in Canadian history…a man known as the “Elon Musk of Canadian Mining.”

And that’s an opportunity that has a chance to move quickly, offering investors the best way to play rising gold prices for maximum potential upside.

I’ll share its amazing story with you in a minute, but first, allow me to introduce myself.

On the Lookout for Profits

I’m Lee Bellinger, editor of Off-Grid Confidential Newsletter.

My monthly, investment-oriented publication delivers ideas to protect and grow your wealth in any market environment.

I spent the early part of my career working in The Swamp of Washington, D.C., helping congressman Dan Coats get legislation passed to help hard-working Americans. I also was on a committee that helped President Reagan promote his vision for missile defense.

Eventually, I got fed up with the ways of Washington and put my experience into helping investors like you navigate global and national trends and make money in the process.

I have to say, I’ve rarely come across an opportunity more attuned with the times and more capable of making investors money than the one I’m about to share with you.

His $5 Million Stake Helped Launch a $40 Billion Gold Behemoth: Is the “Elon Musk of Canadian Mining” Now Poised to Do It Again?

A big part of my enthusiasm for this company is the backing its has received from legendary Canadian mining executive Frank Giustra.

Frank Giustra is widely regarded as one of the most successful mining entrepreneurs in all of North America. He made his initial fortune in the 1980s and 1990s leading the resources-financing group Yorkton Securities and acting as a stockbroker.

In 1996, Giustra left resource investment banking and in 1997 founded Lionsgate Entertainment, which is now one of the world’s largest independent film companies.

Mr. Giustra’s biggest mining success story began in 2001 when he led a group of investors to take control of junior mining company Wheaton River Minerals.

A simple $5 million investment into that company — strategically timed to take advantage of what Guistra believed to be the beginning of a strong bull run for gold — grew by 40x inside of five years.

And by 2012, Wheaton River had merged with Goldcorp and Goldcorp had reached a whopping $40 billion market cap.

There’s even more to Giustra’s story than that, but as you can see from his resume, he knows when to be active in the market and when not to.

That’s why it’s so critical that he has backed this junior gold developer and soon-to-be-producer at this time.

You see…today’s early-stage bull market for gold now appears very similar to the environment Frank Giustra pounced on back in 2001 with Wheaton River Minerals.

In 2023, Giustra saw the gold market at an inflection point and decided to look around for a distressed mine that he could re-start with a combination of capital and expertise.

He found it in the Madsen Mine, an historic mine in a renowned high-grade gold district that was on the auction block after a botched restart.

After finding a top-notch team, Giustra backed West Red Lake Gold to buy Madsen for pennies on the dollar invested.

And that’s only one of my six Reasons why I believe that West Red Lake Gold Mines (OTCQB: WRLGF/TSXV: WRLG) is on the “golden runway” to profits for its shareholders.

Reason #1: West Red Lake is in high-grade gold country.

In the gold mining industry, miners often get by mining ore with about 1 gram of gold per metric ton.

Large scale mining makes that possible, but when miners can gain access to higher-grade ore, that’s a recipe for profits.

The Red Lake area in northwestern Ontario, where WRL’s assets are located, is renowned for its high-grade gold. This gold can come from ore with truly jaw-dropping grades.

For instance, in 2004, Goldcorp’s Red Lake Mine produced 552,000 ounces of the yellow metal from ore grading 77.1 grams per metric ton. That’s over two troy ounces of gold per metric ton. At today’s prices that would equate to $6,500 rock.

The good news at Red Lake is that the grades often get better with depth, which means once you’ve started mining there, it’s common to keep encountering more high-grade gold as the depth of the mine increases.

Which leads me to my second reason West Red Lake Gold Mines (OTCQB: WRLGF/TSXV: WRLG) offers a potential path to shareholder profits:

Reason #2: A mine is already in place at Madsen and was operating as recently as 2022.

West Red Lake’s Madsen Mine has a long history of production, dating back to the 1930s. It generated 2 million ounces from rock grading 9 g/t gold over a near-40-year period through the early 1970s. Then it shut down because the gold price was weak.

Between 1996 and 2014, the shaft was dewatered down to the 1,275-meter level and mine operated again in a limited way.

Then, between 2015 and 2022, prior owner Pure Gold drilled the area, and then permitted, built and ran the mine from 2020 to 2022.

To get Madsen running, Pure Gold completed 110 miles of drilling, navigated the permitting process with success, established a new portal and decline into the mine, built a new tailings storage facility, and built a completely new process plant. (The process plant alone would probably cost more than $250 million to rebuild today.)

Even with all that done, the mine stopped operating when Pure Gold couldn’t deliver enough gold-laden material to the mill and had to file bankruptcy.

So West Red Lake bought the mine, in which Pure Gold had invested $250 million, for just $22 million in 2023.

Consider, this was an operation that, leading up to start-up, had garnered Pure Gold a market cap of almost three-quarters of a billion dollars.

That leads me to…

Reason #3: West Red Lake has the money and the operations personnel to make Madsen a success.

The West Red Lake team is led by President & CEO Shane Williams.

He has the experience that the Pure Gold team did not — namely the experience of putting mines into production.

Between 2013 and 2019 he was Vice President of Operations and Capital Projects for Eldorado Gold. In that role he brought the Lamaque Gold project from economic assessment to commercial production in a lightning-fast 18 months. Prior to that he led mine builds for Eldorado in Turkey and Greece.

In his role prior to joining West Red Lake in 2024, he was leading the historic Eskay Creek mine in British Columbia toward a restart. He spent his early career with two major mining groups — Rio Tinto and the Lundin Group — building mines in Sweden.

In short, he has the expertise to lead West Red Lake Gold Mines (OTCQB: WRLGF/TSXV: WRLG) to a successful and profitable restart of the Madsen Mine.

With financial backing from Frank Giustra and a variety of institutional investors, West Red Lake has the wherewithal to drill and test mine Madsen so that it’s ready to produce profitably.

Reason #4: The path to starting this mine is short, giving West Red Lake a chance to sell gold production into today’s sky-high gold prices.

With gold trading at all-time highs in the $2,600/ounce range, getting into production quickly is a huge opportunity for Madsen.

In that respect, West Red Lake has a significant advantage over would-be-mine-developers who have a deposit outlined but no on-site infrastructure.

Not only does the company own a mine that has largely already been built, but critically it has already been permitted for operation, a process that can take years.

When West Red Lake bought Pure Gold’s Red Lake assets out of bankruptcy it bought underground equipment, two-ramp underground mining access, a 1,275-meter-deep mining shaft, an expandable 800-tonne-per-day mill, a permitted tailings facility and a water treatment plant.

In short, it had almost everything it needed for a restart. The key was just to go back and drill off the resource more intensively to get a better idea of where to mine Madsen’s high-grade gold ore.

Reason #5: Madsen has the potential to grow richer at depth.

As I said, the grade at Red Lake gold mines often improves the deeper the mine.

With mining infrastructure already built down to the 1,275-meter level and the mine half dewatered (with water levels dropping further each day), West Red Lake can drill from underground to more easily and efficiently test for deeper areas of gold.

There’s already good indications that the mineralization at Madsen continues strongly at depth, from past drilling at Madsen, but an intense underground drill effort funded by cash flow from an operating mine has the potential to really test the full potential of this high-grade gold system for the first time, via holes that are short, efficient and accurate.

Plus, the shaft leads down to the high-grade 8-Zone at 1,300 meters. This zone is in slightly different rocks than the rest of the Madsen resource and gold mineralization really liked these different rocks: the 8 Zone deposit has 2.5x the gold intensity of the other gold zones at Madsen. Specifically, the 8 Zone hosts 87,700 ounces of 18 g/t gold indicated and 18,200 ounces of 14.6 g/t gold inferred.

The old time miners who discovered the 8 Zone sank a shaft all the way to this very high-grade zone but only mined a small part of it before the mine shut down in a weak gold market. That shaft means this small but high-grade resource should be relatively easy to access and could contribute significantly to profitability for the re-started mine.

This leads me to my most important reason for bringing West Red Lake Gold Mines (OTCQB: WRLGF/TSXV: WRLG) to your attention now:

Reason #6: West Red Lake is about to enter the “golden runway” for a would-be gold producer

In gold exploration and development, there is a definite pattern to when investors reap the most profits.

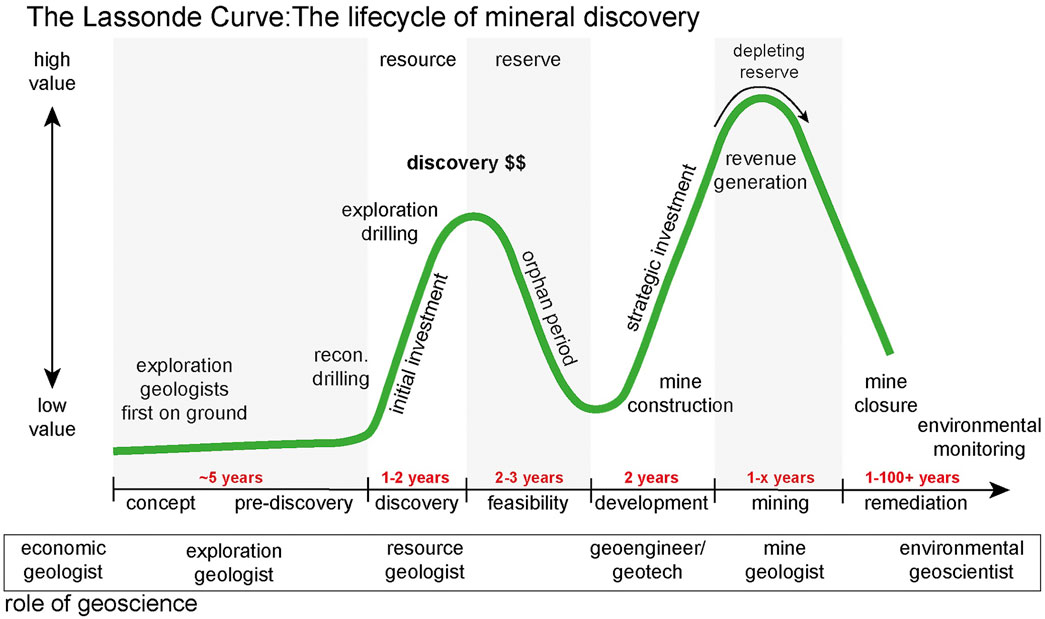

The industry uses a chart called the Lassonde Curve to describe this pattern (see below).

Source: Earth Science, Systems and Society | Geosciences and the Energy Transition

As you can see from the chart, there are two times in a mine’s lifecycle where investors can make good money.

The first is the jump from pre-discovery to discovery of a deposit. This exciting phase – defining a deposit where before there was nothing – creates value. But once the initial excitement of a discovery has worn off, a company is left with the long, hard slog of defining the project’s economics, securing permitting and getting community buy-in.

The next time of investor profits, often the most lucrative time, is called the “golden runwaExit Visual Buildery.”

That’s when a miner gets close to going into operation, which can also be described as going from a cash-consuming entity to a cash generating entity.

This can be a great time to jump on board a budding gold producer, especially, if gold prices are high, as they are now.

The good news for West Red Lake is that with all that in-place infrastructure and existing permitting, the company’s ascent into the ‘golden runway’ should be quick and steep.

With management anticipating a re-start by the second half of 2025, West Red Lake should be turning those high gold prices into cash flow in fairly short order.

Act Quickly

But time is running short to get in on West Red Lake before it enters that ‘golden runway’.

That’s why I’ve written a special report that gives you all the detail I can’t go into here and it’s entitled Canadian Gold Bonanza: Billion Dollar Discovery Revives Legendary Gold Producer.

Protect your wealth and health with Off-Grid Confidential

The report is yours free when you subscribe to my monthly newsletter Off-Grid Confidential.

I started publishing Off-Grid Confidential almost 30 years ago after an early career working as a Washington insider.

Though I grew disillusioned with the way things run inside the beltway, I’ve used my contacts and experience in that world in Off-Grid Confidential to help my readers protect their wealth, health and freedom in a world determined to chip away at all three.

Each month, you’ll get actionable investment ideas delivered right to your doorstep.

Subscribe today, and an annual subscription is yours for just $79 — that’s 56% off of the regular price.

Plus, you’ll receive a total of eight special reports, which include:

- Canadian Gold Bonanza: Billion Dollar Discovery Revives Legendary Gold Producer

- Establishing Your Personal Prescription Drug Back-Up Supply Without Breaking the Law

- Hide It So They Can’t Find It

- Deep State Survival Guide for Pro-Liberty Americans

- Build Your Own Panic Room for Under $500

- Refuse to Be Spied On: 21 Cutting-Edge Strategies for Protecting Your Privacy

- Alert Your Family! 113 Words and Phrases to Never Use Online

- Cloak of Invisibility: 8 Secrets to Protect You from IRS Harassment

Backed by my Money Back Double Guarantee

I’m so confident you’ll be pleased with Off-Grid Confidential that every subscription comes with my iron-clad, money back DOUBLE Guarantee.

1) If you’re not completely satisfied after reading the first issue, just let me know within 30 days, and I’ll gladly refund you every penny you paid with no questions asked. And for your trouble, you’ll get to keep all the Special Reports you received, along with any issues of Off-Grid Confidential.

2) If you cancel after 30 days, you’ll receive a pro-rated refund for the remainder of your subscription and all issues and special reports you’ve received are yours to keep.

Get Started Now

The easiest ways to get your subscription started are to call us toll-free at 1-877-371-1807 (9 a.m. to 3 pm EST, Monday to Friday) and please mention code LNZ01024. Or click the link below.

While your reports will be delivered by mail, you may download Canadian Gold Bonanza: Billion Dollar Discovery Revives Legendary Gold Producer now. It’s your first step in your due diligence on West Red Lake Gold Mines (OTCQB: WRLGF/TSXV: WRLG).

My 3-Point Disclaimer

1) Lee Bellinger is not a certified analyst.

2) All mining operations are speculative.

3) Never invest more than you can safely afford to lose.

https://www.schiffgold.com/commentaries/peter-schiff-golds-potential-is-wildly-untappedii

https://www.thebigscore.com/p/ian-telfer-built-a-21b-gold-major

IMPORTANT NOTICE AND DISCLAIMER on behalf of West Red Lake Gold Mines Ltd. All investments are subject to risk, which must be considered on an individual basis before making any investment decision. This paid advertisement includes a stock profile of West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG). Off Grid Confidential is an investment newsletter being advertised herein. This paid advertisement is intended solely for information and educational purposes and is not to be construed under any circumstances as an offer to sell or a solicitation of an offer to purchase any securities. In an effort to enhance public awareness, West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG) is the sole source of funds for a budget of approximately $1,073,860 provided to the CDMG, Inc. to cover the costs associated with creating, printing and distribution of this advertisement. Off Grid Confidential was paid $35,000 as a research fee. In addition, Off Grid Confidential may receive subscription revenue in the future from new subscribers as a result of this advertisement for its newsletter. CDMG, Inc. will retain any excess sums after all expenses are paid. While this advertisement is being disseminated and for a period of not less than 90 days thereafter, Off Grid Confidential, CDMG, Inc., and their respective officers, principals, or affiliates will not sell securities of West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG). If successful, this advertisement will increase investor and market awareness of West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG) and its securities, which may result in an increased number of shareholders owning and trading the securities, increased trading volume, and possibly an increase in share price, which may be temporary. This advertisement, CDMG, Inc. and Off Grid Confidential do not purport to provide a complete analysis of West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG) or its financial position. They are not, and do not purport to be, broker-dealers or registered investment advisors. This advertisement is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a registered broker-dealer or registered investment advisor or, at a minimum, doing your own research if you do not utilize an investment professional to make decisions on what securities to buy and sell, and only after reviewing the financial statements and other pertinent publicly-available information about West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG). Further, readers are specifically urged to read and carefully consider the Risk Factors identified and discussed in West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG) SEC filings. Investing in microcap securities such as West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG) is speculative and carries a high degree of risk. Past performance does not guarantee future results. This advertisement is based exclusively on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, CDMG, Inc. and Off Grid Confidential cannot guarantee the accuracy or completeness of the information and are not responsible for any errors or omissions. This advertisement contains forward-looking statements, including statements regarding expected continual growth of West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG) and/or its industry. CDMG, Inc. and Off Grid Confidential note that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG) actual results of operations. Factors that could cause actual results to vary include the size and growth of the market for West Red Lake Gold Mines Ltd. (OTCQB: WRLGF/TSXV: WRLG) products and/or services, the company’s ability to fund its capital requirements in the near term and long term, federal and state regulatory issues, pricing pressures, etc. Off Grid Confidential is the publisher’s trademark. All trademarks used in this advertisement other than Off Grid Confidential are the property of their respective trademark holders and no endorsement by such owners of the contents of this advertisement is made or implied. CDMG, Inc. and Off Grid Confidential are not affiliated, connected, or associated with, and are not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made to any rights in any third-party trademarks. The decision to continue with the advancement of the Madsen Mine restart and the Company’s operations and plans with respect thereto, as described herein (the “Madsen Mine Restart”), are based on economic models prepared by the Company in conjunction with management’s knowledge of the property and the existing estimate of indicated and inferred mineral resources on the property set out in the report entitled, “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, with an effective date of July 31, 2022, as amended on April 24, 2024, a copy of which is available on SEDAR+ at www.sedarplus.ca. The Madsen Mine Restart is not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Madsen Mine Restart, in particular: the risk that mineral grades will be lower than expected; the risk that additional ongoing mining operations are more difficult or more expensive than expected; and the risk that production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis undertaken in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate”, “expect”, “estimate”, “forecast”, “planned”, and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release and include without limitation, statements relating to plans for the potential restart of mining operations at the Madsen Mine, the potential of the Madsen Mine; any untapped growth potential in the Madsen deposit or Rowan deposit; and the Company’s future objectives and plans. Readers are cautioned not to place undue reliance on forward-looking information. Forward-looking information involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company’s securities; fluctuations in commodity prices; timing and results of the cleanup and recovery at the Madsen Mine; and changes in the Company’s business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis for the year ended November 30, 2023, and the Company’s annual information form for the year ended November 30, 2023, copies of which are available on SEDAR+ at www.sedarplus.ca. The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law. For more information on the Company, investors should review the Company’s continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.