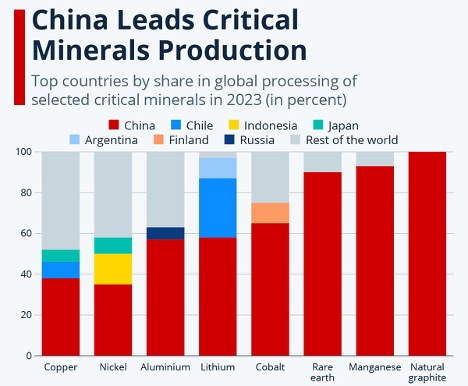

If the past few years have taught us anything, it’s this: whoever controls the supply of critical minerals controls the future… And right now, China has a serious headlock on that supply chain.

For decades, the U.S. let its domestic mining and refining capabilities atrophy while China quietly cornered the global market on dozens of essential elements.

Now, as demand for these minerals explodes due to tech innovation, clean energy, and military modernization, the U.S. finds itself dangerously dependent on a geopolitical rival.

An image of a graph showing China’s dominance of the critical minerals market.

Sources: UNCTAD, OECD, Statista

This isn’t just an issue of economic competition. It’s a full-blown national security concern… In times of war or even diplomatic tension, the country that controls the supply chain holds all the leverage.

Critical minerals are the building blocks of modern society, and America’s ability to secure these resources will determine whether it thrives or falters in the 21st century.

It’s Not Just EVs—It’s Everything

Let’s be clear: this isn’t just about electric vehicles or smartphones. It’s about national security, energy independence, and economic resilience.

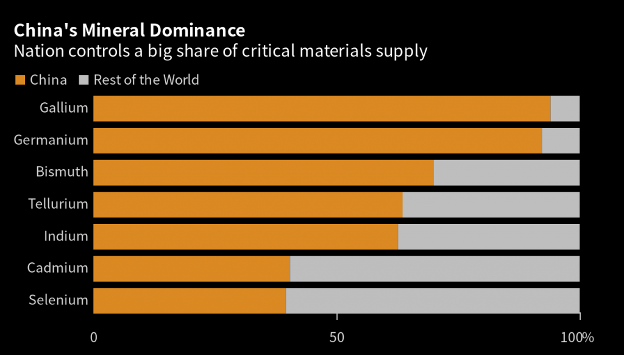

When China restricted exports of germanium last year, it was a loud wake-up call for Washington. That’s not a household name, but it’s absolutely vital to things like semiconductors, solar panels, and defense systems.

More recently, China has also hinted at curbing exports of graphite and rare earth magnets. Those materials are critical to everything from EV motors to wind turbines.

Meanwhile, Russia has considered restricting exports of titanium and helium, adding more instability to an already fragile global supply chain.

These aren’t isolated incidents, either. They’re part of a pattern…

China also restricted rare earth exports in 2010 during a diplomatic dispute with Japan. And Russia’s moves to nationalize or restrict exports of materials like scandium and vanadium have caused serious headaches in aerospace and clean energy sectors.

Every one of these disruptions is a reminder that the U.S. needs to take control of its own supply chains… before it’s too late.

Antimony: The Overlooked Armor Metal

Take antimony, for example…

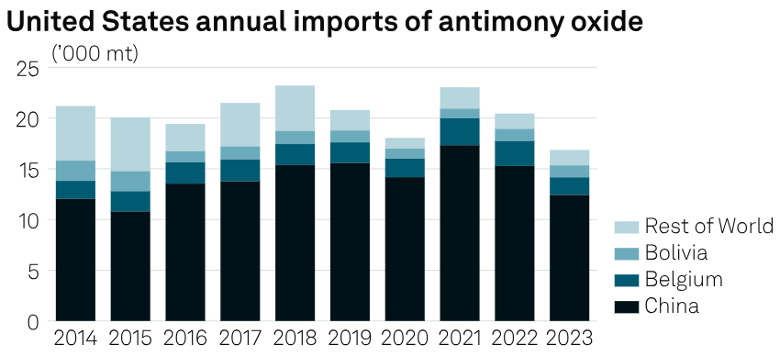

An image of a chart that shows the origin of the United States antimony imports. Sources: S&P Global Market Intelligence, USCBP

The U.S. imports more than 90% of it, mostly from China.

But antimony is used in everything from flame retardants and lead-acid batteries to armor-piercing rounds and semiconductors. It’s not optional. It’s essential.

If China decides to shut the tap, we’re stuck. That kind of strategic vulnerability isn’t just bad economics. It’s a national risk.

Historically, the U.S. produced antimony at sites in Idaho, Nevada, and Alaska. The most promising site today is the Stibnite Mining District in central Idaho. Once a major domestic source of antimony during World War II, this area still holds significant reserves.

Perpetua Resources is working to revive production here with a plan that includes environmental restoration and sustainable mining practices. If successful, it could make the U.S. one of the only Western nations with a meaningful domestic antimony supply.

Beyond U.S. borders, antimony can also be found in friendlier jurisdictions…

Canada has deposits in British Columbia and Newfoundland. In South America, Bolivia has long been a global antimony supplier, and new projects in Peru show promise.

In Europe, Turkey and Russia dominate supply, but antimony has also been discovered in Slovakia and Spain—countries more aligned with U.S. trade and security interests.

Gallium: The Silent Backbone of Modern Warfare

Then there’s gallium. It plays a starring role in high-frequency electronics and military radar systems.

Gallium arsenide and gallium nitride are used in semiconductors for 5G, satellites, LED lighting, solar cells, and missile guidance systems.

And China controls nearly all of it. That’s not an exaggeration…

An image of a chart that shows China’s strangle-hold on global critical mineral supply.

Sources: British Geological Survey, European Commission, Bloomberg

The U.S. has no domestic primary gallium production—zero.

Gallium is typically recovered as a byproduct from bauxite or zinc refining, and since the U.S. has limited refining capacity, our options are slim.

There is potential for secondary recovery from industrial waste streams and reprocessing of certain ores. And some research groups and startups are exploring ways to extract gallium from coal fly ash and other post-industrial materials.

Areas with historical zinc smelting like Tennessee, Missouri, and New Jersey could theoretically become sources of gallium—if the infrastructure and investment are there to support it.

Fortunately, gallium production also occurs in allied nations…

Germany and Hungary have limited refining capacity. Australia, with its strong aluminum industry, could eventually become a non-Chinese gallium source.

Kazakhstan has historically produced gallium, and while politically complex, it remains a somewhat non-hostile alternative.

In South America, Brazil’s bauxite-rich geology holds potential for gallium recovery, though the infrastructure is still catching up.

Barite: The Weight Behind American Energy

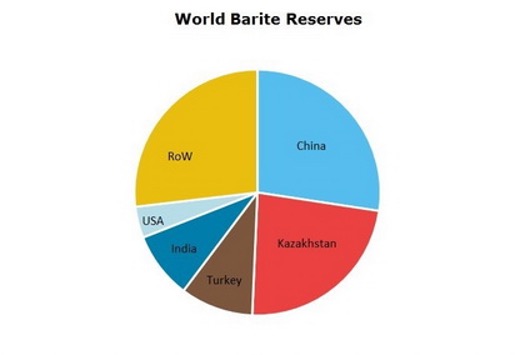

Barite is another sleeper on the critical minerals list. It doesn’t get much attention, but it should…

It’s the heavyweight mineral that keeps oil and gas wells from blowing out. That makes it essential for domestic energy production. Without it, modern drilling would grind to a halt.

Most of our barite comes from overseas, particularly China and India.

An image of a pie chart showing major barite producers.

Source: Merchant Research and Consulting, Ltd.

But it wasn’t always this way. In the 1980s, the U.S. was one of the world’s top barite producers, with active mines in Nevada, Missouri, and Georgia.

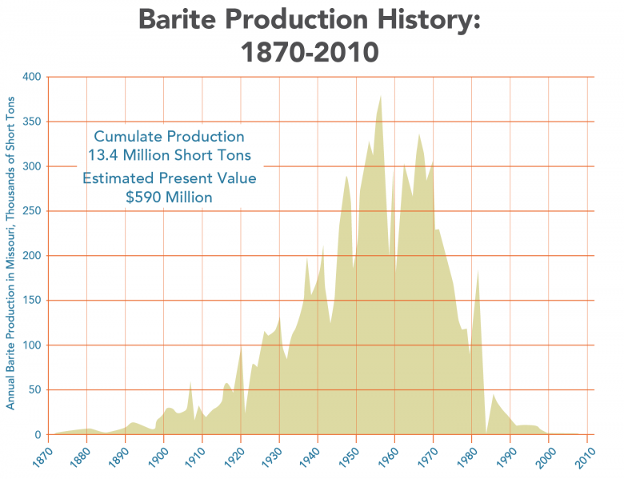

An image of a graph showing historic barite production in Missouri. Source: Missouri Geological Survey

Over time, cheap imports outcompeted U.S. operations, and production dropped sharply.

The good news? The U.S. still has millions of tons of potentially recoverable reserves, especially in Nevada’s Battle Mountain-Eureka trend and areas of Southern California and Texas.

Several junior mining companies are now evaluating these sites for economic viability. If developed, these domestic deposits could reduce reliance on foreign barite and create jobs in rural communities.

Mexico is another friendly supplier, with commercial-scale barite operations that have long served U.S. Gulf Coast oilfields.

Argentina and Brazil also hold barite reserves, especially in shale basins that parallel U.S. geological formations.

In Europe, Spain and Morocco are known producers, and with proper logistics and investment, they could step in to supply Western markets.

Momentum Is Building—But Is It Fast Enough?

Here’s the good news: things are starting to change.

The U.S. government has finally realized that relying on China for critical minerals is a losing strategy. There’s growing bipartisan support to onshore production, fund domestic mining, and streamline permitting for strategic projects.

In 2022, the Department of Defense even awarded grants to U.S. companies exploring domestic production of antimony and other critical minerals. Tax incentives, federal land access, and public-private partnerships are also on the table.

But policy alone isn’t enough. We need the private sector to step up, and that’s exactly where the biggest investment opportunities are hiding.

Small Miners, Big Opportunity

Small companies are popping up across the country to fill the void…

From antimony-rich prospects in Idaho to barite developments in California and Nevada, to potential gallium recovery from secondary refining processes, these early movers could become the backbone of a new American supply chain.

They’re nimble, innovative, and if positioned correctly, hugely profitable.

These companies often operate under the radar but are beginning to attract attention from savvy investors. Their success doesn’t just mean financial gains—it means a safer, more self-sufficient America.

Backing these ventures today is like buying oil companies before the energy boom or lithium miners before the EV surge. The upside is massive, especially for those who get in early.

Déjà Vu: Remember Lithium?

Think about what happened with lithium…

A few years ago, nobody was talking about it. Then the EV boom hit, and suddenly every miner with a lithium play saw their stock explode.

The same dynamic is starting to unfold with these lesser-known but equally critical minerals.

Antimony, gallium, and barite may not be as sexy as lithium or gold, but their demand curves are steep.

As more governments push for domestic sourcing and companies shift away from China, these resources will become increasingly valuable.

The investors who recognize this shift early will be the ones celebrating later.

Get Ahead of the Curve

That’s the angle savvy investors should be looking at right now…

Not just riding the commodity wave, but positioning ahead of the curve in companies that can actually supply the raw materials America needs to break free from China’s grip.

These aren’t just speculative plays. They’re part of a much bigger trend toward national resilience and economic sovereignty.

The window to act is still open, but it won’t be for long. As more capital flows into this space, valuations will rise.

The time to plant your flag in America’s critical minerals renaissance is now—before the crowd shows up.

Unsexy but Unstoppable

Antimony, gallium, and barite might not be flashy. They don’t make headlines like gold or oil. But they’re foundational to everything from defense to data centers.

And if you want to be on the right side of history—and profit—this is your chance to get in before the rest of the market wakes up.

This is just the beginning. The world of critical minerals is vast, complex, and packed with overlooked opportunities.

As supply chains shift and geopolitics evolve, smart investors will keep digging deeper—into new discoveries, emerging technologies, and the companies leading the way.

Make sure to check back often as we continue to uncover the most important trends and investment ideas shaping America’s critical mineral future.