Critical minerals have gone from an obscure government list to front-page news in just a few short years.

These minerals—lithium, gallium, antimony, rare earths, and dozens more—are the backbone of modern life.

They power our smartphones, electrify our cars, strengthen our steel, and even give our military its technological edge.

Why Critical Minerals Are Suddenly on Everyone’s Radar

What makes them “critical” isn’t just their usefulness…

It’s the fact that the United States and its allies import most of them from nations that don’t exactly share our best interests.

China, for example, controls the lion’s share of rare earth processing.

Russia has a strangle grip on certain specialty metals.

That dependence has become a strategic liability—and Washington knows it.

As a result, the U.S. government is scrambling to build secure domestic supply chains.

But here’s where things get interesting: many of these critical minerals aren’t mined directly…

They’re produced as byproducts of gold and silver mining.

How Gold and Silver Mines Produce More Than Meets the Eye

When most people picture a gold or silver mine, they imagine shiny nuggets pulled from quartz veins. Reality, however, is more complex…

Mineralization happens in mixed systems. Hot, mineral-laden fluids flow through cracks in the earth, depositing clusters of metals side by side.

That’s why you’ll often see antimony with silver, tellurium with gold, or gallium and germanium hidden in the same deposits as zinc and lead.

Mining companies targeting precious metals often uncover a second, third, or even fourth hidden revenue stream in the form of these critical byproducts.

And for decades, these byproducts were ignored or sold for pennies on the dollar.

But today, they’re strategic resources—sometimes worth nearly as much as the gold or silver itself.

Geological Formations Where the Magic Happens

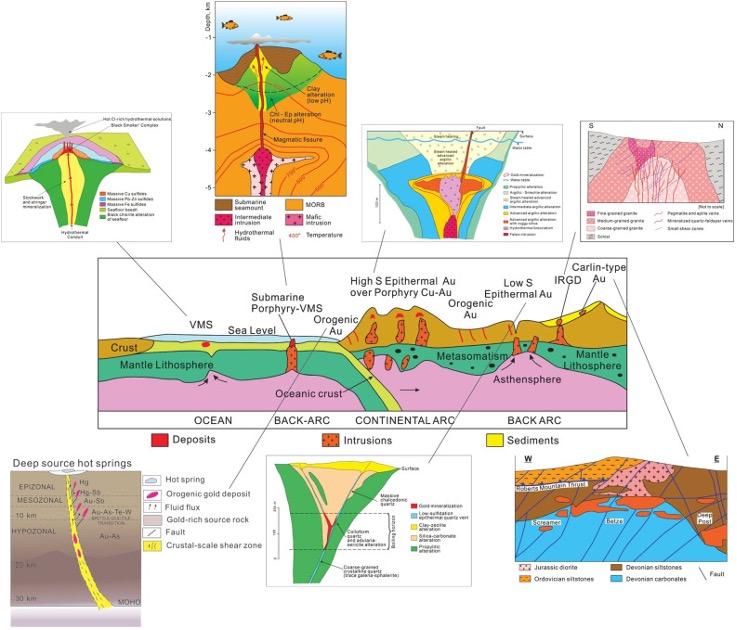

The precious metals-critical mineral connection isn’t random—it comes down to geology…

Different types of deposits form under different conditions, and each one tends to carry its own mix of critical minerals alongside gold and silver.

Take epithermal deposits, for instance. These shallow systems, often linked to ancient hot springs, are famous for hosting rich veins of gold and silver.

But they rarely show up alone. Antimony, arsenic, and tellurium often crystallize right alongside them.

That means a company chasing precious metals in these environments may also find itself sitting on elements vital for defense tech and solar panels.

Carlin-type deposits, which made Nevada a global gold powerhouse, tell a similar story.

These giant sediment-hosted systems are packed with microscopic gold particles, but they also bring along antimony and mercury.

Both of those trace minerals have grown increasingly strategic, making Carlin-type projects more than just “gold mines.”

A collage of select types of gold and silver deposits and the associated critical minerals often found alongside them. Source: ScienceDirect

Then there are polymetallic systems. These are typically silver-rich zones with plenty of lead and zinc in the mix.

Those base metals act like carriers, delivering gallium, indium, and germanium in small but valuable concentrations…

Once dismissed as impurities, today these three are indispensable for semiconductors, fiber optics, and advanced electronics.

Finally, porphyry deposits—the giant copper-gold systems that often stretch for miles—show us another dimension of the connection.

While miners target copper and gold in these systems, they frequently discover molybdenum and rhenium as well.

Both minerals are critical for strengthening steel and building jet engines, making porphyries a quiet powerhouse in the critical minerals supply chain.

Together, these deposit types illustrate just how intertwined gold, silver, and critical minerals really are.

Lessons From History: When Precious Metals Turn Critical

This isn’t just theory—it’s already happened. In fact, history offers several examples where gold and silver mines transformed into strategic critical mineral suppliers…

In the early 20th century, silver mines in Idaho’s Coeur d’Alene district were found to produce germanium and gallium alongside their main ores.

Decades later, those “extras” became essential for transistors and satellite communications.

Nevada’s Carlin Trend, one of the most famous gold regions on earth, also produced significant amounts of antimony as a byproduct.

Antimony has since become vital for flame retardants and defense alloys.

Mexico’s rich silver belts have long yielded tellurium, once considered worthless, now indispensable in high-efficiency solar panels.

These examples prove the point: yesterday’s overlooked waste streams can become tomorrow’s profit centers.

And with governments pushing hard for domestic sources, today’s gold and silver miners may find themselves at the center of a critical minerals boom.

Four Precious Metals Miners with Critical Mineral Potential

Investors don’t need to look far to find companies positioned at this intersection. Four miners in particular show promise.

Coeur Mining (NYSE: CDE) operates polymetallic projects in Nevada and Alaska.

Alongside its core silver and gold, it can tap into zinc and lead deposits that often contain gallium and germanium.

And as an added benefit, Coeur’s mines are already part of the U.S. supply chain conversation.

Vista Gold (NYSE: VGZ), with its massive Mt. Todd project, is a gold-first story. But geologically, it sits in a region known for antimony and tellurium—two minerals rising fast on the critical radar.

Then you’ve got West Point Gold (OTC: WPGCF). It’s a small exploration company that’s developing assets where gold and copper occur together.

That means exposure to molybdenum, a critical mineral for advanced steel and aerospace alloys. Its story could easily broaden beyond precious metals.

Finally, we come to Apollo Silver. This tiny company owns the Calico project in California and an option on the Cinco de Mayo project in Mexico.

These silver-rich systems could also yield antimony, barite, and zinc as well…

With silver already eyeing critical status (more on that below), Apollo has the potential to become both a precious metals play and a strategic minerals asset.

Together, these miners demonstrate how investors can gain exposure to both the traditional upside of gold and silver and the emerging value of critical minerals.

When Precious Metals Become Critical Minerals

Here’s the kicker: what if gold and silver themselves were classified as critical minerals?

The U.S. Department of the Interior has already floated the idea of adding silver to the list…

Why? Because silver is indispensable for solar panels, electronics, and military systems.

That recognition would elevate silver mines to “critical mineral” status overnight, bringing silver miners faster permitting, government backing, and new investor attention.

And while gold hasn’t been suggested for the list yet, it could…

Beyond jewelry and finance, gold has crucial roles in electronics, aerospace, and medicine.

And as central banks hoard gold to secure national wealth, its status as a “critical” resource for stability becomes undeniable.

If both gold and silver win that designation, every gold and silver mine in the U.S. instantly becomes part of the critical minerals supply chain.

That’s not just a bureaucratic shift—it’s a once-in-a-generation revaluation of the entire sector.

The Bottom Line: Get Ahead of the Curve

Critical minerals are no longer a niche conversation. They’re at the center of national security, energy transition, and technological dominance.

And gold and silver miners are uniquely positioned to deliver both the traditional value of precious metals and the modern necessity of critical byproducts.

Coeur, Vista, West Point, and Apollo aren’t just digging for ounces anymore—they’re digging for leverage in America’s fight for mineral independence.

And investors who understand that dual role are a step ahead of the crowd.

The time to act is now. Learn more about the critical minerals story. Study the miners that are straddling both worlds…

And consider building positions in these companies while Wall Street still thinks of them as “just” gold and silver plays.

Because the reality is far bigger: these miners are about to become cornerstones of a secure, U.S.-controlled critical minerals supply chain.