As world governments ramp up their efforts to phase out hydrocarbon energy sources like coal, oil and natural gas in favor of alternatives like wind and solar, one thing is becoming abundantly clear: wind and solar are not up to the challenge of replacing fossil fuels. These “green” energy solutions have been struggling to provide consumers with reliable energy for years … even before the AI megatrend sent demand for electricity into the stratosphere.

This supply/demand imbalance is driving renewed interest in non-hydrocarbon, extremely reliable sources of electricity like nuclear power in what many in the nuclear industry are calling a renaissance.

For retail investors, this resurgence offers a compelling opportunity, particularly in the uranium mining sector.

Here’s why uranium and its role in nuclear energy make for an investment avenue worth considering.

Uranium: The Cornerstone of Nuclear Energy

Uranium, a dense metal, is the primary fuel for nuclear reactors…

Its unique properties allow for the generation of large amounts of energy from small quantities, making it a key player in the global energy mix.

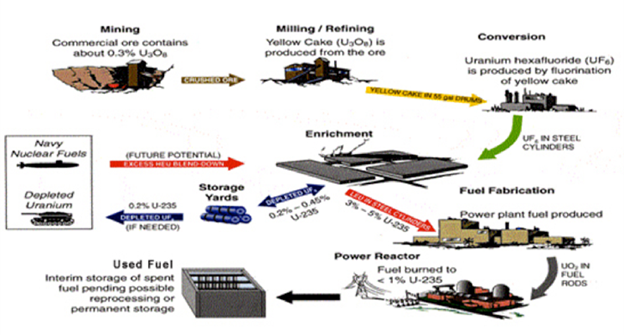

The process of uranium mining, which involves extracting uranium ore from the ground and refining it into usable fuel, is a crucial first step in the nuclear power production chain.

Nuclear Power: A Sustainable Energy Solution

In the quest to combat climate change, nuclear power stands out for its ability to provide stable, high-density, and low-carbon energy.

Unlike fossil fuels, nuclear reactors emit no greenhouse gases during operation. And unlike solar panels and wind turbines, nuclear energy can be produced 24 hours a day, seven days a week.

Growth Prospects in the Nuclear Industry

The nuclear industry is projected to grow significantly in the coming decades.

The World Nuclear Association estimates that global nuclear power capacity could increase by over 45% by 2040.

The anticipated expansion of the nuclear sector directly impacts uranium demand and prices. Analysts predict a steady rise in uranium prices, driven by increasing demand and constrained supply due to underinvestment in new mining capacity over the past decade. This supply-demand imbalance presents a lucrative scenario for uranium mining investments.

Historical Gains: The Early 2000s Bull Market

Historically, the uranium market has experienced significant bull runs…

In the early 2000s, uranium prices skyrocketed from around $10 per pound to peak at over $130 per pound by 2007.

Investing in Uranium Mining: A Strategic Move

For retail investors, investing in uranium mining offers exposure to the burgeoning nuclear energy sector.

This can be achieved through direct investment in uranium mining companies or via uranium-focused exchange-traded funds (ETFs).

Investors should look for companies with strong resource bases, efficient operations, and the potential to scale up production in response to rising uranium demand.

The Environmental and Social Governance (ESG) Angle

Investing in uranium also aligns with ESG principles…

By supporting a key component of the low-carbon energy sector, investors contribute to the global effort to mitigate climate change.

Navigating Risks and Volatility

Like any commodity-based investment, the uranium market is subject to volatility and geopolitical risks.

Investors should be aware of the cyclical nature of the market and the regulatory environment surrounding nuclear power and uranium mining.

The Bottom Line

The case for investing in uranium is anchored in the global shift towards sustainable energy and the pivotal role of nuclear power in this transition.

For retail investors looking to capitalize on the growth of the nuclear sector and contribute to a greener future, uranium mining presents a unique and promising opportunity.

As with all investments, due diligence, a clear understanding of market dynamics, and a long-term perspective are key to navigating this exciting sector.