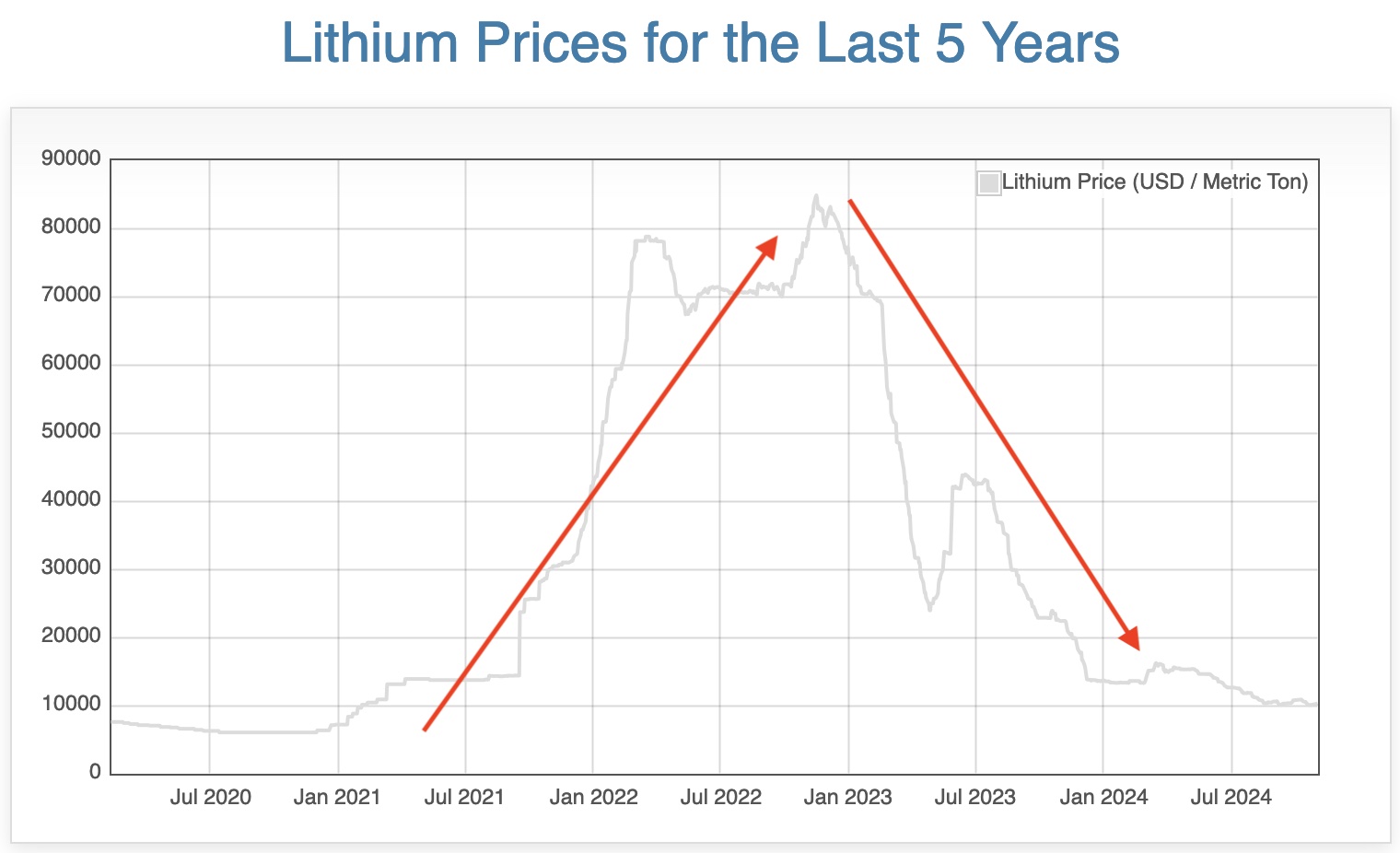

In the whole world of investing, there’s probably fewer markets more challenging to analyze than the junior mining industry. There are a lot of reasons. First when you assess a company, say a tech company, you look at their financials. Their revenue, earnings, free cash flow. You can judge their valuation based on their competitors, based on their performance over a period of time. This doesn’t show up so well with junior miners. Given the business they’re in, their financial numbers are generally non-existent. So savvy mining investors learn to look at other factors to size up a company’s investment potential. One of the most important is the price of the underlying ore they’re mining. After all the drilling, sampling, testing and mapping is done and the indicated resources are laid out for all to see, there are still studies that need to be completed on the economic viability of building a mine and putting it into production. And that is all about the price of the metal they’re mining. Because digging up and processing ore is generally a fixed cost. Profit margins are almost solely determined by the price that a metal sells for. Take lithium for example. Back in 2021 and 2022, the days of China’s EV boom, demand for the key battery metal was off the charts. Its price soared to over $80,000 per metric ton… In that kind of environment, interest in lithium miners was booming. But then came China’s economic contraction which tapped the brakes on their EV industry, and the price of lithium reversed sharply. And interest in miners went with it. So as much as a mining investor needs to know about the company they’re looking to buy, they also need to know about the metal they’re mining. Today one metal is standing out that will make for attractive economic viability well into the future…

Source: Daily Metal Prices

The Case for Silver

While the financial media has been glued to the bull market taking hold in gold, silver has been charging ahead in its own quiet bull market.

Silver

Source: Macrotrends.net

Like gold, silver is a precious metal that investors run to when political and economic uncertainty starts ramping up in the world. In nominal terms, the white metal has reached price levels not seen in 12 years (the spike that ensued after the financial crisis following the housing bust). And given the heightened tensions around the world, its price is likely to remain strong. (Good news for silver miners.) But there are more reasons to expect silver’s strength to continue — namely that even at its current levels, silver is actually quite cheap! Let’s examine two measures that precious metals traders often consider. First there is the “gold-silver” ratio. The gold-silver ratio is a measure of how much silver it takes to buy an ounce of gold. In simple terms, the lower the ratio, the stronger the price of silver. (The fewer ounces it takes to buy an ounce of gold.) Conversely, a higher ratio suggests that silver is still under priced. Take a look at the chart below:

Gold-Silver Ratio

Source: Macrotrends.net

Since the US closed the gold window in 1971 (allowing the price to freely float), the gold-silver ratio has averaged between 55 and 60:1. Today, however, the ratio has accelerated out of that range indicating that silver, while rallying on its own, is still underpriced relative to an ounce of gold. Again, this is a key ratio that metals traders look at. And at these levels, silver is still a bargain. Another measure of the relative value of silver is its “inflation adjusted” price. Ongoing inflation over time distorts the price of everything. Prices that are adjusted for inflation remove that distortion and flatten the playing field. Looking at the nominal chart you’d think that silver is pushing all time highs. But when you adjust historical prices for inflation, it really isn’t. In fact, it has a LOT of room to run…

Silver (Inflation Adjusted)

Source: Macrotrends.net

It’s too bad that silver is often the great forgotten metal. Because looking at its price through these different lenses, you can see it’s strong — with a lot more room to run. Even more room to run than gold! And that bodes well for both silver investors and miners…