Silver just ripped past $39 per ounce. That’s a big deal. It marks a new recent high and confirms what savvy investors have been whispering for months: silver’s bull market has officially begun.

An image of a chart showing silver’s ascent and potential for more growth ahead. Source: Dall-E

But here’s the thing… this isn’t the peak. It’s the first inning of what could become the most powerful silver rally of our lifetimes. Prices are just starting to heat up—and the best silver stocks could see explosive gains as the metal climbs.

Let’s walk through what’s going on, why silver is likely headed much higher, and which mining stocks are poised to benefit the most.

Silver Is Finally Waking Up

For years, silver lagged behind. While gold grabbed headlines by pushing past $2,000 per ounce, silver felt like the forgotten metal. But patient investors knew better. Historically, silver tends to move slower than gold in the early stages of a bull market… then suddenly leap ahead.

That’s what we’re seeing now.

Since bottoming in 2020 around $14 per ounce, silver has more than doubled.

An image of a chart showing silver and gold YTD price gains. Source: Google

And over the past year, it’s begun to outpace gold, just as it did during the massive run-ups in 2010–2011 and 1979–1980.

Based on those historical patterns, this could just be the warm-up…

Why Silver Is Headed Much Higher

Silver isn’t rallying by accident. There are strong tailwinds building behind it. Some are obvious, some not so much…

Here are the major forces driving this move:

- Central Bank Buying

Central banks around the world are loading up on gold. While they aren’t buying silver directly, their activity is waking up global interest in precious metals.

As gold gets bid up, silver—its faster, more volatile cousin—tags along and then outruns it. Once investors see gold making new highs, they naturally ask: “What about silver?”

- Industrial Demand Is Surging

Unlike gold, which is mostly a store of value, silver is both a monetary and industrial metal. It’s used in everything from solar panels and electric vehicles to semiconductors and medical devices.

As the world moves toward electrification and renewables, demand for silver is exploding. According to the Silver Institute, industrial demand hit a record high in 2024—and it’s showing no signs of slowing down.

- The Electrification Boom

The green energy transition runs on silver. Every EV, solar cell, and data center adds to the demand pile. And with governments around the world still pumping hundreds of billions into clean energy, silver isn’t just riding a wave—it’s riding a tidal surge of demand.

There simply isn’t enough mined supply to keep up.

- Sticky Inflation

Inflation might be cooling in the official numbers, but anyone who buys groceries, pays rent, or fills up the tank knows better. The cost of living is still rising, and traditional safe-haven assets like silver are back in fashion.

If the Fed starts cutting rates again—as Wall Street is now betting that it will—it could light another fire under silver.

- Geopolitical Stress

The world’s a mess. Wars in the Middle East and Eastern Europe. Rising tensions between the U.S. and China. Fragile supply chains. Political division at home.

Precious metals thrive in chaos, and silver has always played a key role in times of uncertainty. When people lose trust in governments, currencies, and banks—they turn to tangible assets. They turn to silver.

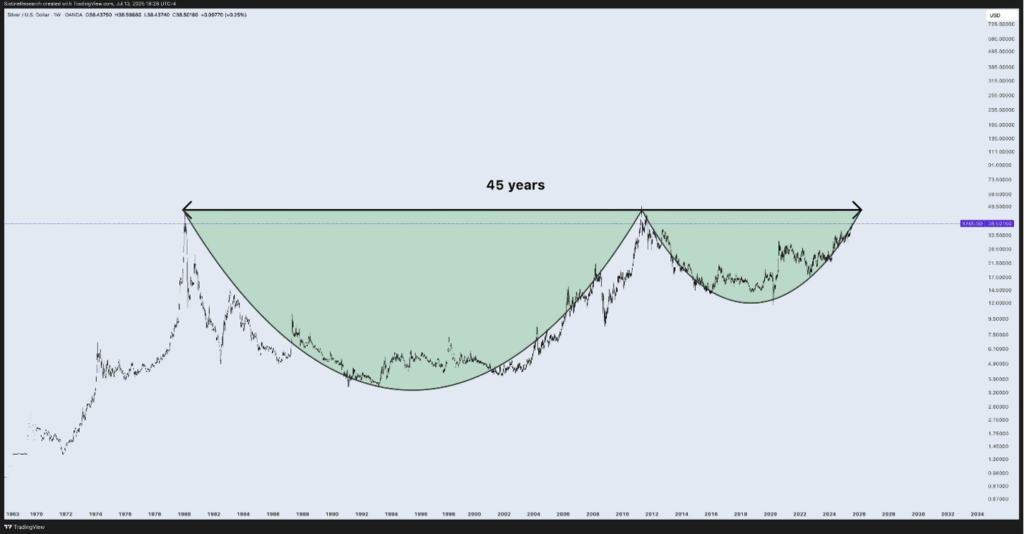

- Bullish Technical Setup: Cup and Handle

Take a look at silver’s long-term chart and you’ll see something technical traders love—a textbook “cup and handle” formation. This pattern often shows up before major breakouts.

An image of a chart showing silver’s cup-and-handle pattern forming over the past 45 years. Source: TradingViews

The big rounded “cup” formed over years of sideways action, followed by a smaller “handle” pullback. Now that prices are breaking above resistance, the pattern suggests a massive upside target. Technicals are confirming the fundamentals—and that’s a powerful combo.

- Retail Investors Haven’t Even Shown Up Yet

Here’s the kicker: silver is rallying, and hardly anyone is paying attention. ETF inflows are still light. Fund manager exposure remains low. Retail interest? Practically nonexistent.

But that’s what makes this opportunity so powerful. When prices keep climbing—and media headlines start screaming “Silver Hits $50!”—the crowd will pour in.

By then, it’ll be too late to get the best deals.

Four Silver Stocks for the Next Big Move

Now, if you want to play the coming silver boom for maximum profit, don’t just buy the metal. Buy the miners…

Silver mining stocks offer leverage to rising prices—often multiplying gains when silver surges.

Here are four silver miners worth watching:

Silvercorp Metals (NYSEAMERICAN: SVM)

Silvercorp is one of the biggest silver producers in the world. They’ve got low costs, strong margins, and no debt.

The company also pays a dividend and has a history of savvy acquisitions. Its stock price is already outpacing the metal, up 70% so far in 2025. And as silver climbs, Silvercorp’s share price could explode.

Pan American Silver (NASDAQ: PAAS)

This is another of the biggest names in the space…

Pan American has mines across Latin and North America and a long track record of production.

Plus, the company recently expanded its asset base by acquiring Yamana’s silver and gold assets, giving it even more upside and some exposure to the yellow metal as well.

When institutional money flows into silver, it often starts with names like PAAS.

Avino Silver & Gold Mines (NYSEAMERICAN: ASM)

This one is a smaller, more speculative play than Silvercorp and Pan American, but it could have even more potential profit…

Avino operates in Mexico and has been steadily ramping up production. It also owns a massive tailings project that could boost future output. Despite being up 380% in 2025, this stock still has big upside potential if silver keeps running.

Apollo Silver (TSXV: APGO / OTCQB: APGOF)

And finally, we get to our most speculative, but also potentially most profitable silver miner, Apollo Silver…

Apollo is still in the development stage, focused on advancing its Waterloo and Langtry projects in California and gain access to its newly acquired site in northern Mexico.

While it doesn’t produce yet, it controls a large, high-grade silver resource (one of the largest in the Americas, in fact)—and that can be extremely valuable in a rising price environment.

Apollo is a classic early-stage bet with big torque to the silver price.

The Window Is Still Open—for Now

Silver at $39 is exciting, no doubt. But it’s not the end. It’s the beginning…

If history repeats—and it often does—silver could be heading back toward $50 per ounce and beyond. And if it breaks that psychological level, the sky’s the limit.

The key is to act before everyone else.

Before the mainstream media catches on.

Before Wall Street wakes up.

Before the Reddit crowd starts screaming about silver squeezes again.

The smartest investors are already moving into position.

They’re buying physical silver.

They’re grabbing shares of the best mining stocks.

And they’re preparing for what could be the most explosive phase of the precious metals bull market.

You still have time. But not much.

Want In Before the Crowd?

If you believe silver is going higher—and all signs say it is—then now’s the time to get invested.

Look into physical silver, ETFs, and especially silver mining stocks. Focus on quality names with strong assets and upside torque.

Because once the crowd shows up, this ride is going vertical.