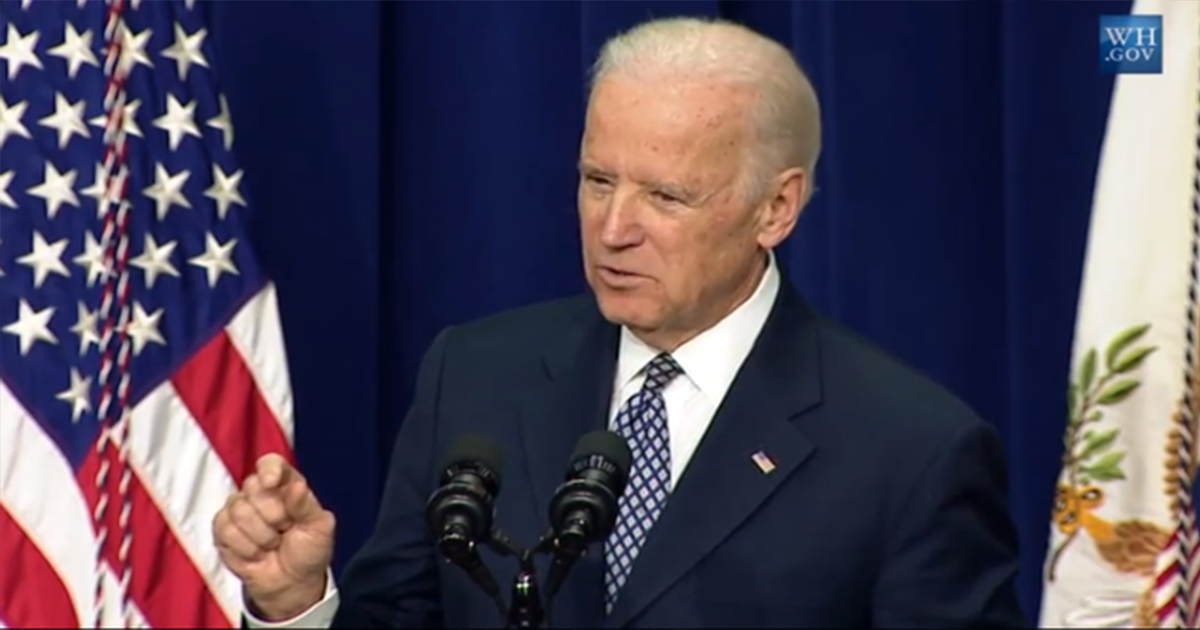

“I’ll fulfil my oath, and I will honour the constitution. On January 20th, we’ll have a peaceful transfer of power here in America.”

-President Joe Biden

A peaceful transfer of power…

In his last days in office, it seems like his administration is doing everything it can to leave Donald Trump a steaming bowl of chaos.

We recently wrote about the escalating involvement in the Ukraine / Russian war. Biden gave permission to use US missiles (ATACMS) to target assets inside Russia. Shortly after, he reversed himself and promised anti-personnel mines as well.

The geopolitical front is getting messier by the day.

But things are stirring up on the domestic side as well.

The Government’s National Pastime

With technically unlimited funds and no personal responsibility for the fallout, the government (politicians actually) has always been a free-spending institution.

It goes back to the Reagan era. During his administration throughout the 80s he added $1.4 trillion in deficits and nearly doubled the national debt. He also increased government spending by 2.5% per year which was a total increase of nearly 22% over his entire term.

So to be fair, massive overspending isn’t just a Biden or Democrats thing. But it is a thing nevertheless and Biden and the Democrats are particularly good at it.

All pandemic/stimulus nonsense aside, between the Inflation Reduction Act, the Chips and Science Act, and the Bipartisan Infrastructure Bill the government earmarked over $1.9 trillion to be spent.

A sizable chunk of all that money is still sitting around.

But not for long if Biden gets his way. He (or his administration) is on the fast track to spend as much of that money as possible. Semafor News reported:

In the final months of President Joe Biden’s term, Transportation Secretary Pete Buttigieg told Forbes his department will push out as many federal funds from Biden’s Bipartisan Infrastructure Law for major road, airport, bridge and rail projects as possible. Buttigieg’s urgency to disperse the funding before January 20 may be because his successor could simply stop issuing grants, particularly to projects that Biden favors and President-elect Donald Trump hasn’t, including high-speed rail and climate change-related upgrades.

The IRA money is headed out the door as well. According to ZeroHedge:

On Tuesday, the US Department of Energy announced it would offer a direct loan of up to $6.57 billion (including $5.975 billion of principal and $592 million of capitalized interest) to finance Rivian’s EV factory in Stanton Springs North, near the City of Social Circle, Georgia.

FWIW, Rivian has burned through $19 billion and has yet to turn a profit since its launch in late 2021.

The Chips Act is going back into high gear finalizing nearly $8 billion in direct funds to struggling (former) chip giant Intel. (On top of $3 billion in defense contracts it already received.)

Why stop there when there are so many other places to spend…

On his way out of the White House, President Biden is reportedly making a last-minute plea to Congress for $24 billion in aid for war-torn Ukraine to bolster its military support and replenish US stocks that had dwindled.

This is in addition to the $4.6 billion in Ukrainian debt they plan to forgive.

And speaking of forgiving debt, the administration is moving forward on a plan to forgive another $4.5 billion in student loans. (The administration boasts that this will bring its total loan forgiveness to $175 billion.)

What’s It All Have In Common?

Rampant government spending is inflationary.

We all saw what happened once all the stimulus money started hitting the economy. It was like dumping gas on an already blazing fire.

These last ditch efforts by the Biden admin to shovel as much money out the door as possible will ultimately be felt as inflationary pressures in the economy.

Just last week, the BEA reported its Personal Consumption Expenditure (PCE) index. The Fed’s favorite inflation indicator just upticked to 2.3% on the headline number and 2.8% on the ex-food and energy number.

We’re not suggesting those bumps were the result of this latest barrage of spending. But previous deficit spending has been filtering through the economy which has the effect of keeping prices elevated.

Deficits certainly don’t fix inflation. And the threat of a resurgence of higher prices remains a possibility.

And why the “macro” post on a mining site?

Because these inflationary threats are going to keep serious rally potential in play for precious metals like gold and silver.

Especially silver.

Given the white metal’s other sources of demand (namely industrial, jewelry etc), the added inflationary pressure will likely keep prices at attractive levels.

And that could make miners who specialize in silver especially attractive as well…