They’ve been the ultimate safe haven for centuries.

During times of economic and geopolitical uncertainty, the world instinctively falls back on the source of protection that it has held since ancient times — precious metals. And the times we are living in now are nothing if not economically and geopolitically uncertain!

First, the US dollar — the world’s “reserve” currency — is facing some serious headwinds.

Thanks to the government’s fiscal irresponsibility, the national debt has reached nearly $36 trillion putting our debt-to-GDP ratio at over 120%. The only way to deal with this problem is the way they have dealt with in the past.

By devaluing the dollar.

And given that the rest of the world is supposed to rely on the US dollar for most global transactions, a devalued dollar means higher prices across the board. This is giving a lot of countries pause when it comes to their own economic futures.

Then there’s the unrest abroad. In just the past two and a half years, Russia invaded Ukraine, Hamas launched an attack on Israel, the Houthis in Yemen have effectively closed down shipping lanes through the Red Sea.

Notwithstanding all the added deficits/debt that are being racked up, these conflicts have put the world’s security on a knife edge.

And the gold market has taken notice of all this…

Source: Macrotrends.net

Central banks around the world have been stocking up on gold. According to bullion exchange Money Metals:

Central banks globally added a net 483 tons of gold through the first six months of the year, 5 percent above the record of 460 tons in H1 2023.

By and large, China has been the leading buyer through all of this. But they haven’t been the only one.

Turkey, India, Poland, Uzbekistan, the Czech Republic and many others have all been loading up to drive prices higher as well.

But one notable buyer has extended its interest in another direction.

A Buyer Looking Elsewhere

Russia, one of the players at the center of all this disruption, has been among the nations increasing their gold reserves. However, it recently announced that it would be increasing its precious metals holdings beyond the yellow metal.

According to a Bloomberg translation of Russian news agency Interfax:

MOSCOW. Sep 30 (Interfax) – The Russian Finance Ministry proposed to allocate 51.5 billion rubles in 2025 to buy precious metals and gemstones, according to the draft federal budget for 2025 and the planning period of 2026-2027.

And their targets include an often forgotten precious metal… silver.

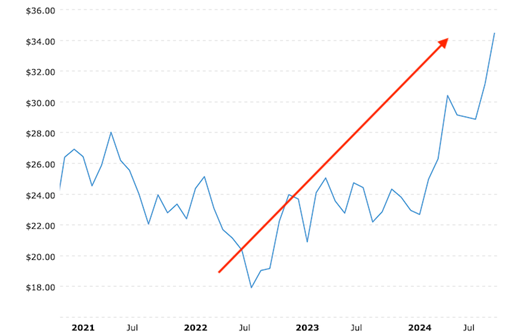

While it generally doesn’t get the same kind of coverage as gold, silver has been on a quiet tear of its own.

Source: Macrotrends.net

You can certainly bet the Russian central bank has noticed this as well. And it’s highly likely their interest in silver will be just the tip of the central bank spear.

Russia is one of the leaders of the BRICS — a group of countries who have become openly hostile to the US dollar domination of world trade.

Originally made up of Brazil, Russia, India, China and South Africa, they’ve recently been joined by Iran, Egypt, Ethiopia and the UAE. (US ally, Saudi Arabia’s RSVP is still pending.)

The coverage of their activities in the news has been growing in recent years.

Now… the US dollar is not going to be replaced by another currency any time soon (after 50 years, it’s far too embedded in the global economy). But the influence this group exerts as a whole does have the potential to impact certain markets.

Like silver.

When India, China, Brazil, South Africa and other members start following Russia’s lead diversifying their metals portfolio, it’s likely to be an explosive situation for he white metal.

The bottom line is, with the market’s attention focused on gold, silver is an underreported metal. But, given the building demand from central banks, it has no less potential for significant price gains.

That’s good news for metals investors who hold silver. And it’s better news for the companies that mine it.

More on that to come…