Mark Twain supposedly said, “History doesn’t repeat itself, but it often rhymes.” Whether he actually said it or not doesn’t matter—because the truth behind that phrase is undeniable…

The patterns of the past are like a cheat sheet for the present. They don’t give you the answers word for word, but they hum the same melody.

And yet, despite the clues written across every page of financial history, most investors—and especially the so-called “experts”—never learn the tune.

They react, they parrot, they follow. That’s why you’ll hear the same recycled commentary on every mainstream outlet today if you tune in:

“Silver’s rally has gone too far, too fast.”

Funny thing, though—that’s exactly what they said almost 50 years ago. And they couldn’t have been more wrong then… just like they’re wrong now.

The Echo Chamber of Modern “Expertise”

If you’ve ever watched a financial news panel, you know how it goes…

One talking head mutters something about “profit taking” or “technical resistance,” and the rest nod along like bobbleheads in a Tesla on autopilot. It’s groupthink with a price tag.

That’s the problem with consensus: it’s comfortable. It’s safe. And it’s almost always late.

By the time the “experts” tell you silver’s hot, it’s already up 50%.

By the time they warn you it’s overbought, it’s usually gearing up for another leg higher.

And right now, those same voices that completely missed the breakout in gold and silver are calling for a crash.

They’ve decided that the rally’s gone far enough—that the party’s over before the band even tunes up.

But if you’ve studied your financial history, you’ll recognize this script word for word. Because in 1976, the exact same chorus sang the exact same song…

1976: The “End” of a Rally That Was Only Beginning

Let’s rewind to the mid-’70s…

Inflation was rising, interest rates were climbing, and investors were terrified. Sound familiar?

Silver had just hit rock bottom—under $4 an ounce—and a quiet accumulation phase was starting to stir.

But almost immediately, the experts stepped in…

They called it a “dead cat bounce.” They warned investors not to “chase the rally.” They wrote columns predicting a collapse back to $3, maybe even $2.50.

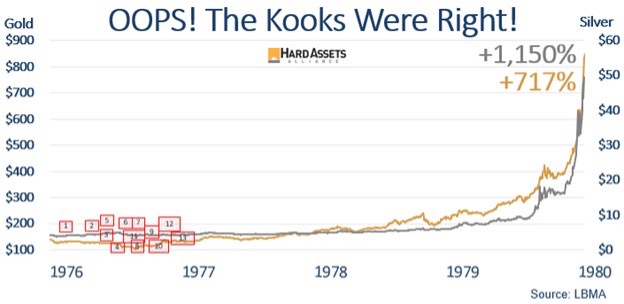

In fact, between 1976 and early 1977, there were no fewer than thirteen major calls by banks, brokers, and media outlets declaring the silver rally “unsustainable.”

An image of a chart showing dates in 1976 where analysts called the silver bull market “dead.” Source: Hard Assets Alliance and London Bullion Market Association

If you’d listened to them, you’d have sold every ounce you had.

But those who tuned out the noise—the contrarians, the rebels, the investors who saw the rhyme between inflation, monetary chaos, and rising precious metals—held tight.

And they were rewarded with one of the greatest bull runs in commodity history…

The Run of a Lifetime: 1976–1980

Once silver broke past its early resistance, there was no looking back. It climbed from under $4 in 1976 to nearly $50 by January 1980.

An image of a chart showing the continuation of silver’s rally despite 13 major firms calling it “dead.” Source: Hard Assets Alliance and London Bullion Market Association

That’s a more than 1,100% gain in four years—life-changing returns for anyone bold enough to ignore the experts and trust the pattern.

The mainstream financial press didn’t suddenly “get religion” either…

They kept calling tops all the way up. Every 10% correction brought out a new round of obituaries: “Silver Mania Fading,” “Bubble About to Burst,” “Speculative Fever Cooling Off.”

But the rally had deeper roots—fundamentals that went beyond headlines and hysteria.

Inflation was eating savings alive. The dollar was losing credibility. And gold, silver’s older cousin, was surging right alongside it as faith in fiat currency evaporated.

Sound familiar again? It should. Because we’re living through that same dynamic today—only this time, the stakes are even higher.

Today’s Silver Market: The Rhyme Continues

Fast-forward to 2025…

Inflation isn’t “transitory”—it’s sticky. Global debt is higher than ever. Governments are printing, borrowing, and spending like there’s no tomorrow.

Central banks are hoarding gold at record rates. Industrial demand for silver—from solar panels to AI-powered electronics—is booming.

And yet, once again, the “experts” are warning of a crash. They missed the rally from $20 to $48, and now they’re praying for a pullback to justify their bad calls.

It’s almost comical: the same analysts who mocked precious-metals investors a year ago are now begging for a correction so they can say, “See? We told you so.”

But the chart doesn’t lie…

An image of a chart showing silver’s rally in 2025 and its recent consolidation around $48. Source: Google Finance

Silver is consolidating after a major breakout—just like it did in 1976. The sentiment is skeptical. The mainstream is dismissive.

And that’s exactly what you want to see in the early stages of a historic bull run.

If history rhymes, then we’re only in the first verse of a very profitable song.

Why the “Experts” Always Miss It

The tragedy of mainstream finance is that it confuses caution with wisdom…

Analysts who call for crashes sound “responsible.” They look smart on camera. But the markets don’t reward appearances—they reward conviction.

In the late ’70s, those who waited for validation missed the entire move. But the smart money didn’t listen to pundits—they studied the cycles.

They understood that precious metals thrive when inflation surges, when trust in government wobbles, and when currencies lose credibility.

Check, check, and check. That’s the world we’re living in right now.

The experts are still stuck arguing over short-term fluctuations while the long-term story unfolds right in front of them.

And when silver hits $50 again—or $75, or $100—they’ll pretend they saw it coming all along.

Learning from the Past—or Repeating It

So here we are again, half a century later, staring at the same setup: inflationary pressure, geopolitical tension, central-bank gold hoarding, industrial demand surging, and a public slowly waking up to the realization that fiat currency can’t buy trust.

The rhyme is crystal clear. And yet, once again, the herd is missing the music.

You can almost hear the echoes of 1976 in today’s headlines: “Silver’s Rally Unsustainable,” “Overheated Market,” “Correction Imminent.”

It’s déjà vu, and not in a good way—unless you’re smart enough to see it for what it is: a massive opportunity hiding behind mainstream skepticism.

Because the truth is, we’re likely at the beginning—not the end—of the biggest precious-metals rally in nearly fifty years.

The Bottom Line: Don’t Miss the Rhyme

In 1976, investors who listened to the crowd got left behind, while those who trusted the pattern made fortunes.

Today, the setup is the same—but the potential is even greater, because silver isn’t just money anymore. It’s a critical industrial metal for everything from solar power to electric vehicles to next-generation computing.

That means this bull market isn’t built on speculation—it’s built on necessity.

So don’t make the same mistake the experts are making.

Learn from history. Trust the rhyme. And get positioned before silver’s next surge turns this quiet rally into a full-blown mania.

Because the difference between remembering the past and reliving it… could be the difference between watching others get rich—and becoming one of them.

And if you want real leverage on this move, don’t just buy silver—learn more about the companies producing it.

That’s where the biggest gains, and the life-changing profits, will come from.