Demand Shock:

This Overlooked U.S. Asset Is On the Verge of a Massive Bull Run

Silver has become absolutely essential for AI, defense, and national security.

America’s supply chain is 70% foreign…but that could soon change.

By Jason Williams • Chief Editor of The Wealth Advisory Newsletter

Wednesday, October 8, 2025 9:00 A.M. CDT · 10 min read

By Jason Williams • Chief Editor of The Wealth Advisory Newsletter

Wednesday, October 8, 2025 9:00 A.M. CDT · 10 min read

6 Reasons Why This Under-the-Radar Silver Stock Could Deliver Windfall Profits to Early Investors As Silver Demand Continues to Soar

Thanks to an unprecedented supply-demand imbalance — and America’s urgent need to secure domestic mineral supplies — investment in U.S.-based silver assets is surging.

Silver industrial consumption hit a record 680.5 million ounces in 2024, driven by exploding demand from AI infrastructure, defense contractors and renewable energy projects.

And analysts are projecting even higher consumption in 2025.

In the midst of this record demand, a few silver mining stocks have been blowing up, delivering gains of 111.7%, 275.8%, even 425.9%!

But the highest-upside opportunities may still be ahead of us.

"Silver demand is going to skyrocket. We're heading into a massive deficit. The industrial world has no idea how tight this market is about to get."-- Keith Neumeyer, CEO of First Majestic Silver

My name is Jason Williams, and I’m editor of The Wealth Advisory, an independent investment research service dedicated to uncovering asymmetric opportunities for serious investors.

My research recently turned up an under-the-radar U.S. silver company with one of the largest undeveloped silver deposits on American soil.

The little-known company positioned to capitalize on America’s silver renaissance is Apollo Silver Corp. (TSXV: APGO); (OTC: APGOF).

I’ve recently introduced this company to my subscribers and now I want to share with you my 6 reasons why Apollo Silver Corp. could deliver potential windfall profits in the months ahead.

REASON #1: Silver Mining Stocks Have Been Soaring as the Bull Market Rages On

Experts remain extremely bullish on silver prices, which have been driven higher by both supply constraints AND explosive demand growth that’s created one of the most compelling investment landscapes in decades.

The revolution is driving massive increases in demand for silver to support AI data centers, national defense systems, and clean energy infrastructure.

With this surge in demand comes unprecedented growth in silver consumption. Over 680 million ounces were consumed globally in 2024 alone, the highest figure in recorded history.

As a result of this unstoppable megatrend, a few silver mining stocks have delivered some of the most spectacular gains of any sector.

This is happening with a number of impressive companies that feature proven assets…and have delivered potentially massive returns:

MAG Silver Corp. (NYSE: MAG) started 2024 trading at just $10.29 per share. But as silver’s strategic importance became clear and industrial demand surged, shares rocketed to $21.79 by mid-2025. That’s a staggering 111.76% increase in just 18 months. A modest $10,000 investment could potentially have grown to $21,176.

Discovery Silver Corp. (OTC: DSVSF) has been even more explosive. The stock opened January 1, 2025 at $0.462 and has surged to $2.43 … an incredible 425.9% increase this year alone. Early investors who put $5,000 into DSVSF at the start of the year could potentially be sitting on $26,295 today.

Avino Silver & Gold Mines (NYSE: ASM) delivered similar fireworks, climbing 275.8% year-to-date. A modest $5,000 position could now be worth $18,801.

Why Small-Cap Silver Stocks Offer the Greatest Leverage

These three companies’ share prices have performed well because they had the right combination of substantial silver resources, competent management, and favorable timing. They weren’t lucky…they were positioned.

With one of the largest undeveloped silver resources in North America and a proven management team, Apollo Silver Corp. has all the ingredients that have made other silver stocks such spectacular winners.

As silver demand begins to dramatically outstrip supply (the Silver Institute projects deficits exceeding 200 million ounces by 2026) even more explosive growth in silver mining stocks appears inevitable.

REASON #2: Silver Has Become Essential for the Building of Modern Digital and Military Infrastructure

Thanks to its strong electrical conductivity, thermal efficiency, and corrosion resistance, silver has become irreplaceable in thousands of advanced systems that define 21st century life.

And demand is exploding across every critical sector:

Artificial Intelligence and Data Centers

Every AI data center relies on silver-laced circuit boards, semiconductors, and high-performance cooling components. As AI computing power scales exponentially, so does silver consumption. A single large data center can contain tons of silver across its server infrastructure.

Defense and Military Systems

America’s military superiority is greatly dependent on silver. Guided missile systems, drone navigation, radar installations, satellite communications, and next-generation weapons platforms…each of these needs silver!

Energy Infrastructure

Every solar panel that’s manufactured contains silver for electrical conductivity…as much as 20 grams per panel. With renewable energy installations ramping up globally, this represents massive and growing silver demand. But solar panels are just part of the story. Next-generation grid infrastructure and energy storage systems also require substantial silver components.

Consumer Economics

Take a look at that smartphone you’re holding because it most likely contains silver. In fact, nearly every smartphone manufactured contains about 0.35 grams of silver. Laptops, tablets, automotive electronics, and electric vehicles each consume significant silver per unit. With billions of these devices manufactured annually, the cumulative demand is staggering…as is its potential impact on silver prices moving forward.

According to the Silver Institute, industrial demand for silver hit a record high of 680.5 million ounces in 2024…and this surge is just beginning. The International Energy Agency projects this demand to double by 2030 as technology adoption accelerates globally.

"Silver demand is going to skyrocket. We're heading into a massive deficit. The industrial world – especially EVs, solar, and AI – has no idea how tight this market is about to get."-- Keith Neumeyer, CEO of First Majestic Silver

But what’s important to keep in mind about silver is that while demand is exploding, supply isn’t keeping pace.

The world now faces a structural deficit of more than 184 million ounces annually…and that’s a gap that’s widening every month.

As we all know, the combination of increasing demand and decreasing supply leads to higher prices. And when silver prices rise, companies with large, developable silver deposits see their valuations multiply rapidly.

That’s exactly why Apollo Silver Corp. (TSXV: APGO); (OTC: APGOF) appears positioned to offer significant potential upside for investors in the near term.

REASON #3: America Must Secure Domestic Silver Supplies or Face Dangerous Dependency on China

Right now, the United States is dangerously exposed.

Simply put, the U.S. needs to dramatically expand its domestic production of silver supply chain immediately…or face potentially catastrophic shortages that could put both our economic and national security at risk.

The chilling reality is that today America imports nearly 70% of its silver.

This leaves our country dangerously vulnerable to supply chain disruptions or hostile trade actions by foreign governments. And this dependency has reached crisis levels at precisely the moment when silver has become more strategically important than ever.

China’s Controls 40% of Global Silver Production

The threat is real and immediate as China controls 40% of global silver production…and they’ve been aggressively stockpiling strategic metals while restricting exports when it serves their interests.

Chinese silver production is now roughly 14 times U.S. levels, giving Beijing enormous leverage over global supply chains.

And keep in mind, China has already demonstrated its willingness to weaponize critical mineral supplies, cutting off exports of gallium and germanium to pressure Western nations.

If China did the same thing with its silver exports, it could potentially cripple America’s defense capabilities, technology sectors, and energy infrastructure virtually overnight.

Washington Makes Domestic Silver a National Priority

Fortunately, Washington is finally taking action to address this emergency. In fact, President Trump’s return to office has triggered an unprecedented focus on critical minerals independence.

Already in 2025, President Trump has signed multiple, game-changing executive orders to prioritize U.S. production:

- Executive Order 14241 — activated the Defense Production Act to fast-track domestic mining

- Executive Order 14272 — launched Section 232 investigations into foreign mineral imports, specifically targeting China’s market manipulation

- Executive Order 14285 — opened new territories for strategic metals exploration and recovery

These orders represent the most aggressive critical minerals policy in decades, and could trigger significant upside potential for a number of U.S.-based silver projects.

The message from Washington is crystal clear: Domestic silver production has become a national security imperative.

A Massive Opportunity Has Now Emerged.

This scenario creates an unprecedented opportunity for companies like Apollo Silver Corp. (TSXV: APGO; OTC: APGOF) that control large, developable silver resources on American soil.

With one of the largest undeveloped silver deposits in the continental United States, Apollo Silver Corp. is uniquely positioned to help America reduce its dangerous dependency on foreign silver supplies while potentially delivering massive returns to investors as government policies increasingly favor domestic production.

As tensions with China continue and America’s silver needs keep growing, companies with U.S.-based silver projects could see potential rapid growth in valuation.

Reason #4: With Potentially $4 Billion of Silver in the Ground…Apollo Silver Controls a Massive U.S. Resource

Apollo Silver Corp.’s flagship Calico Project in California could be one of North America’s most valuable silver assets.

Based on extensive drilling and resource modeling, the Calico Project hosts 125 million ounces of Measured & Indicated silver, plus another 57 million ounces Inferred.

Located in California’s San Bernardino County, the Calico Project sits in one of America’s historically richest silver districts.

This region was once a booming silver hub in the late 1800s, producing over $20 million in silver (in today’s dollars) from hundreds of active mines. The nearby town of Barstow was the epicenter of one of America’s most productive historical silver districts.

Now, Apollo Silver is bringing that legendary district back to life with 21st-century tools and a development strategy designed to move the project along quickly…and in a way that is easily scalable.

What makes this opportunity even more exciting is the project’s geology, as it has a number of key advantages.

The Calico Advantage

✓ Over 71 g/t average silver grades at Waterloo deposit

✓ Located on private land in mining-friendly California

✓ Near-surface, lower-cost extraction potential

✓ Close to existing infrastructure and power

✓ Proven management team with billion-dollar track record

For example, unlike many silver juniors, Calico is not buried deep underground or locked behind complex geology. The mineralization at the property is shallow, continuous, and ideal for open-pit development.

That translates to lower operating costs, a faster path to production, and significantly higher leverage to rising silver prices.

And the project’s location in San Bernardino County, offers year-round road access, proximity to rail and power, and the support of a mining-experienced labor force.

Additionally, the Calico Project offers outstanding silver grades.

The majority of Calico’s silver is concentrated in the Waterloo deposit, where silver grades average over 100 grams per tonne (g/t), well above industry averages and high enough to support profitable operations even at lower silver prices.

But there’s even more to the story as hidden within Apollo’s Calico Project is a second, often-overlooked asset that could provide outsized strategic leverage: barite.

Barite is a U.S.-designated critical mineral essential for oil and gas drilling, and America imports over 75% of its barite supply, mostly from China.

This dual-critical mineral profile could provide Apollo Silver Corp. with enhanced strategic value and potentially accelerated permitting under federal critical minerals programs.

A Potentially Massive Opportunity Where Scale Meets Development-Ready Status

In 2025, Apollo Silver Corp. dramatically expanded Calico’s footprint by more than 285%, optioning adjacent claims after surface sampling revealed exceptional results including up to 20.7 g/t silver, 14.1 g/t gold, 5.7% lead, and 22.8% zinc.

These results suggest significant polymetallic upside that could add substantial additional value to the project. The discovery of gold mineralization, in particular, could provide important economic benefits and help improve overall project economics.

With 182 million ounces of silver resources (measured and indicated plus inferred), plus substantial barite credits and newly discovered gold zones, Calico represents one of the most compelling development opportunities in the North American mining sector.

The scale is genuinely massive, as few undeveloped silver projects anywhere in the world can match Calico’s combination of size, grade, infrastructure access, and jurisdictional advantages.

But that’s before considering the strategic premium that domestic U.S. critical mineral projects could command, the additional value from barite and gold credits, or the potential for silver prices to surge as supply deficits widen.

For investors considering the opportunity with Apollo Silver Corp. (TSXV: APGO); (OTC: APGOF), Calico offers the potential of a strategic asset that could play a crucial role in America’s minerals independence.

REASON #5: World Class Management Team with a Proven Track Record of Success

One of the most compelling aspects of Apollo Silver Corp. is the proven leadership team that has been assembled to lead the company.

This management team has successfully built, financed, and exited billion-dollar mining ventures across the globe:

Leadership That Delivers

Andrew Bowering, Chairman:

Chris Cairns, CFO:

With Apollo Silver, you’re backing proven winners who understand how to transform large-scale resources into profitable operations, and ultimately, significant shareholder value.

This management pedigree, combined with their massive California silver resource, helps make Apollo Silver Corp. one of the most intriguing investment opportunities I’ve seen in years…and it’s part of why I’ve been urging my subscribers to start their due diligence on the company immediately.

REASON #6: World Class Management Team with a Proven Track Record of Success

The scenario that is now unfolding for Apollo Silver Corp. (TSXV: APGO); (OTC: APGOF) could deliver staggering returns to early investors, driven by both powerful macro trends and company-specific catalysts that could trigger rapid revaluation. Let’s start with the…

Macro Forces Driving Silver Higher:

AI Revolution: Each and every AI data center that is built – and demand is soaring for new data centers – uses silver-laced components, semiconductors, and cooling systems.

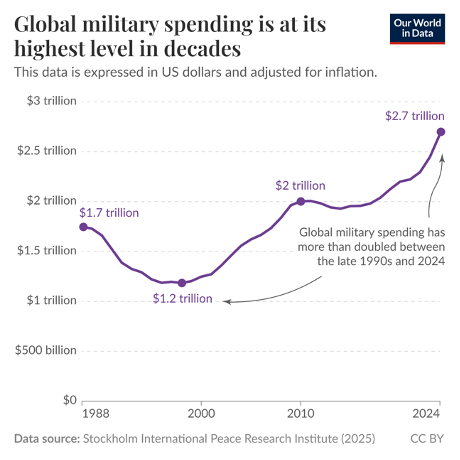

Defense Buildup: Global military spending hit $2.44 trillion in 2024, the highest since the Cold War…and silver is a huge part of our national defense capability.

Energy Transition: Solar panels and grid infrastructure require massive silver inputs.

Supply Deficit: With a 184+ million-ounce shortage growing monthly, the supply-demand story for silver keeps adding pressure for higher prices.

Meanwhile, the gold-to-silver ratio sits at extreme levels above 85:1, which is far above the historical average of 20:1 to 40:1. When this ratio has reached such extremes in the past, silver has staged dramatic catch-up rallies.

This includes 2008, when the ratio peaked above 80:1, and then silver rocketed over 400% in two years as well as 2020 when the ratio hit 125:1 and sliver doubled in just four months.

"When the gold-to-silver ratio is this stretched, it's not just a buying opportunity. It's a once-in-a-decade event."— Eric Sprott, Legendary Precious Metals Investor

In addition to those macro forces driving silver prices higher, this unique opportunity is also being triggered by a number of…

Apollo-Specific Catalysts Creating Additional Upside:

Active 2025 Drill Program: Apollo is currently executing a drilling campaign at Calico, targeting both resource expansion and new discovery zones. Positive drill results could significantly increase the project’s resource base and attract major investor attention.

Resource Expansion Potential: The company’s recent 285% land expansion has already yielded exceptional surface sampling results (up to 20.7 g/t silver, 14.1 g/t gold). Systematic exploration of these new areas could unlock substantial additional resources.

Apollo’s Waterloo deposit already includes barite resources of 2.7 million tons barite (Indicated) and 0.72 million short tons barite (Inferred) (Sept 2025 MRE)], which could add significant strategic value and attract partnerships with energy sector companies needing domestic barite supplies.

Strategic Partnership Opportunities: With Calico’s scale and strategic importance, Apollo could even potentially attract joint venture partners, strategic investments, or acquisition interest from major mining companies or government entities seeking domestic silver exposure.

For investors seeking the best way to play the red-hot silver bull market for maximum upside, Apollo Silver Corp. appears to be the play. The company benefits from both the macro silver supercycle and multiple internal catalysts that could drive significant returns in the near term.

With 125 million ounces of measured and indicated silver plus another 57 million ounces inferred active development programs, and expanding resource potential, Apollo could see explosive revaluation as both silver prices surge and company-specific milestones are achieved.

Bottom Line: Apollo Silver Stands Poised for Significant Potential Upside in the Near Term

Early investors in companies with this combination of macro tailwinds and internal catalysts have sometimes seen returns of 300%, 500%, or more as markets wake up to the potential of both the underlying commodity and the company’s strategic assets.

Apollo Silver Corp. (TSXV: APGO); (OTC: APGOF) appears well-positioned to be a potential breakout winner as both silver’s supercycle and the company’s development move forward in a meaningful way.

There’s so much more to the Apollo Silver Corp. (TSXV: APGO); (OTC: APGOF) story than I have room to discuss here.

I’ve prepared an in-depth Special Report that takes an even closer look at this game-changing silver opportunity and why it could deliver such exceptional returns for early investors.

It’s called The Silver Supercycle: Explosive Potential Returns from America’s Overlooked Critical Metal, and you can get a FREE copy immediately.

Simply enter your information below to claim your report

Inside, you’ll discover:

- Why silver is being called the new critical metal of the 2020s — and how global supply shortages could ignite a historic bull market.

- How Apollo Silver’s California and Mexico projects could position it as a strategic U.S. supplier in the coming mineral independence push.

- The key milestones investors should watch for as Apollo advances its development plans.

This report is completely free — no obligation, no credit card required. Just enter your details below to get instant access and see why Apollo Silver could be one of the most compelling silver stories of the decade.

Sign up to receive your FREE report – The Silver Supercycle: Explosive Potential Returns from America’s Overlooked Critical Metal.

This FREE research report reveals the full story behind the opportunity with Apollo Silver Corp.

As always, my goal is to help you spot the kinds of opportunities most investors overlook — the ones sitting on the verge of major movement as global trends shift.

That’s exactly what I believe we’re seeing with Apollo Silver. Between the tightening supply, surging industrial demand, and America’s renewed focus on critical minerals, this could be one of those rare setups that rewards early action.

Don’t miss your chance to read the full details inside my new report.

Simply enter your information below and I’ll send you your free copy of The Silver Supercycle: Explosive Potential Returns from America’s Overlooked Critical Metal right away.

To your wealth,

Jason Williams

Editor, The Wealth Advisory

All investments are subject to risk, which must be considered on an individual basis before making any investment decision. This paid advertisement includes a stock profile of Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO). The Wealth Advisory is an investment newsletter being advertised herein. This paid advertisement is intended solely for information and educational purposes and is not to be construed under any circumstances as an offer to sell or a solicitation of an offer to purchase any securities. In an effort to enhance public awareness, Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO) provided advertising agencies with a total budget of approximately USD$1,750,157 and is the sole source of funds to cover the costs associated with creating, printing and distribution of this advertisement. The Wealth Advisory may receive subscription revenue in the future from new subscribers as a result of this advertisement for its newsletter, but The Wealth Advisory has not received nor will receive financial compensation from Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO) related to the publication of this research report. The advertising agencies will retain any excess sums after all expenses are paid.

While this advertisement is being disseminated and for a period of not less than 90 days thereafter, The Wealth Advisory, the advertising agencies, and their respective officers, principals, or affiliates will not sell securities of Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO). If successful, this advertisement will increase investor and market awareness of Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO) and its securities, which may result in an increased number of shareholders owning and trading the securities, increased trading volume, and possibly an increase in share price, which may be temporary. This advertisement, the advertising agencies and The Wealth Advisory do not purport to provide a complete analysis of Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO) or its financial position. They are not, and do not purport to be, broker-dealers or registered investment advisors.

This advertisement is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a registered broker-dealer or registered investment advisor or, at a minimum, doing your own research if you do not utilize an investment professional to make decisions on what securities to buy and sell, and only after reviewing the financial statements and other pertinent publicly-available information about Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO). Further, readers are specifically urged to read and carefully consider the Risk Factors identified and discussed in Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO) public disclosure documents filed on SEDAR+. Investing in microcap securities such as Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO) is speculative and carries a high degree of risk. Past performance does not guarantee future results. This advertisement is based exclusively on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the advertising agencies and The Wealth Advisory cannot guarantee the accuracy or completeness of the information and are not responsible for any errors or omissions.

This advertisement contains forward-looking statements, including statements regarding expected continual growth of Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO) and/or its industry. The advertising agencies and The Wealth Advisory note that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO) actual results of operations. Factors that could cause actual results to vary include the size and growth of the market for Apollo Silver Corp. (OTC: APGOF); (TSXV: APGO) products and/or services, the company’s ability to fund its capital requirements in the near term and long term, federal and state regulatory issues, pricing pressures, etc. Apollo Silver Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable securities laws.

The Wealth Advisory is the publisher’s trademark. All trademarks used in this advertisement other than The Wealth Advisory are the property of their respective trademark holders and no endorsement by such owners of the contents of this advertisement is made or implied. The advertising agencies and The Wealth Advisory are not affiliated, connected, or associated with, and are not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made to any rights in any third-party trademarks.

*Footnotes where references have been made to Apollo’s resources:

1 Please refer to the cautionary notes and further information regarding the Calico Project mineral resource estimates, see Apollo news release dated September 4, 2025. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve.

2 Please see Apollo news release dated September 4, 2025.

3 The reader is cautioned not to treat the Pozo Seco and the Upper Manto historical estimates, or any part of it as a current mineral resource or reserve. An independent Qualified Person has not completed sufficient work to classify this as a current mineral resource or reserve and therefore the Company is not treating this historical estimate as a current mineral resource or mineral reserve. The reliability of the historical estimate is considered reasonable and relevant to be included here in that it simply demonstrates the mineral potential of the Cinco de Mayo Project. Refer to below for cautionary notes and further information regarding Cinco de Mayo Project historical mineral resource estimates.

CAUTIONARY NOTE

(to be included in every published document where reference has been made to Apollo’s resources)

Information Concerning Calico Resource Estimate

The Calico Silver Project 2025 Mineral Resource Estimate (“2025 MRE”) has been prepared by Derek Loveday, P. Geo., of Stantec Consulting Services Ltd., an independent Qualified Person, in co-operation with Mariea Kartick, P.Geo. (independent Qualified Person for drilling data QA/QC) and Johnny Marke P.G. (independent Qualified Person for resource estimation) in conformance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with the Canadian Securities Administrators National Instrument (“NI”) 43-101. Please see Apollo Silver Corp’s news release dated September 4, 2025, for more information on the 2025 MRE.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve. For all references to the 2025 MRE included herein, please note that:

• The MRE is represented by the base-case estimate using 47 g/t Ag equivalent and 0.17 g/t Au cut-off grades for Waterloo and 43 g/t Ag for Langtry.

• Ounces are reported as troy ounces.

• CIM definitions are followed for classification of the mineral resource.

• For the Waterloo Property, a AgEQ cut-off grade was calculated using the following variables: surface mining operating costs (US$2.8/st), processing costs plus general and administrative cost (US$26.5/st), silver price (US$28/oz), barite price (US$120/t), zinc price (US$1.22/lb), gold price (US$2,451/oz), and metal recoveries (silver 65%, gold 80%, barite 85%, zinc 80%). For the Waterloo Property gold-only resources the gold cut-off grade was calculated using above gold price, gold recovery and gold-only processing costs plus general and administrative cost (US$8.2/st).

• For the Langtry Property, a silver-only equivalent cut-off grade was calculated using above silver price, silver recovery and silver-only processing costs plus general and administrative cost (US$24/st).

• Resources are constrained to within a conceptual economic pit shell targeting mineralized blocks within the specified cutoff grade limits shown in the table. Specific gravity for the mineralized zone is fixed at 2.44 t/m3 (13.13 ft3/st). For the Waterloo Property only the following drillhole grades were capped prior to estimation: Ag 450 g/t, Au 2 g/t, Ba 31% and Zn 7%.

• No drilling was completed on the Waterloo Property and Langtry Property since the declaration of the 2023 MRE for Waterloo and 2022 MRE for Langtry. The 2025 MRE update accounts for changes in commodity prices, mining costs since 2022/2023, and barite testing of existing drill samples from the Waterloo Property.

• Totals may not represent the sum of the parts due to rounding.